categories

All Categories

- Bitcoin

- Centralised Exchanges

- Crypto

- Crypto Asset Volatility

- Crypto Correlations

- Crypto Governance

- Crypto in the Portfolio

- Crypto Valuations

- DeFi

- ESG

- Ethereum

- Investment Highlight

- Regulation

- Security and Privacy

- Social Media Influence

- Stable Coins

- Traditional Finance and Crypto

- Uncategorized

- UNSDG

- Web 3.0

Authors

All Authors

Solv: Investment Highlight

by Quinn Papworth

What is Solv Protocol?

Solv Protocol is a Bitcoin staking platform designed to give users access to yield opportunities while maintaining liquidity and composability within DeFi Central to this is SolvBTC, a multichain wrapped Bitcoin, which acts as a reserve asset and is complemented by liquid staking token derivatives, enabling yield generation across numerous DeFi platforms. SolvBTC’s goal is to unify Bitcoin liquidity across multiple chains, serving as a universal Bitcoin reserve for DeFi users without having to deal with fragmented liquidity or the risks tied to other individually wrapped BTC assets.

Traction & Ecosystem

Solv has experienced significant growth year to date with its TVL increasing roughly 2750% from US$67 million on 1 Jan to US$1.91 billion as of the time of writing.

Much of this growth has been fueled by the Solv platform offering distinct yield opportunities on BTC through their liquid staking tokens, allowing investors exposure to numerous yield opportunities on their BTC.. A great example of this is Solv’s Babylon LST SolvBTC.BBN which grants investors exposure to one of the most anticipated BTC projects of the cycle, Babylon, while remaining fully liquid. Solv has utilised its expertise to become one of the dominant stakers in the Babylon ecosystem becoming ~25% of the total delegations. As such Solv’s LST sits as one of few liquid options to gain early exposure to a highly anticipated protocol being built on BTC.

This strategy of providing appealing yield opportunities to BTC holders has proven to be highly replicable and successful for Solv with over 400,000 users and more than 80% of assets allocated to yield-generating strategies. SolvBTC is now deployed across 10 major blockchain networks allowing for the greatest liquidity. Some other notable Solv integrations include:

- Ethena – Allows users to gain access to sUSDe yields, Ethena Sats, and Solv points all while remaining liquid through the SolvBTC.ENA token that can then be used further within DeFi protocols.

- Core – Allows Bitcoin holders to stake their Bitcoin on the Core Network and earn returns denominated in the CORE token white remaining liquid through SolvBTC.CORE.

- Jupiter – Allows users to participate in a delta-neutral trading strategy by providing liquidity to the Jupiter Liquidity Provider (JLP) Pool while minimising market fluctuations through hedging on centralised exchanges. This allows users to earn yields generated from trading fees, borrowing fees, and other pool activity while remaining liquid through SolvBTC.JUP.

The Staking Abstraction Layer

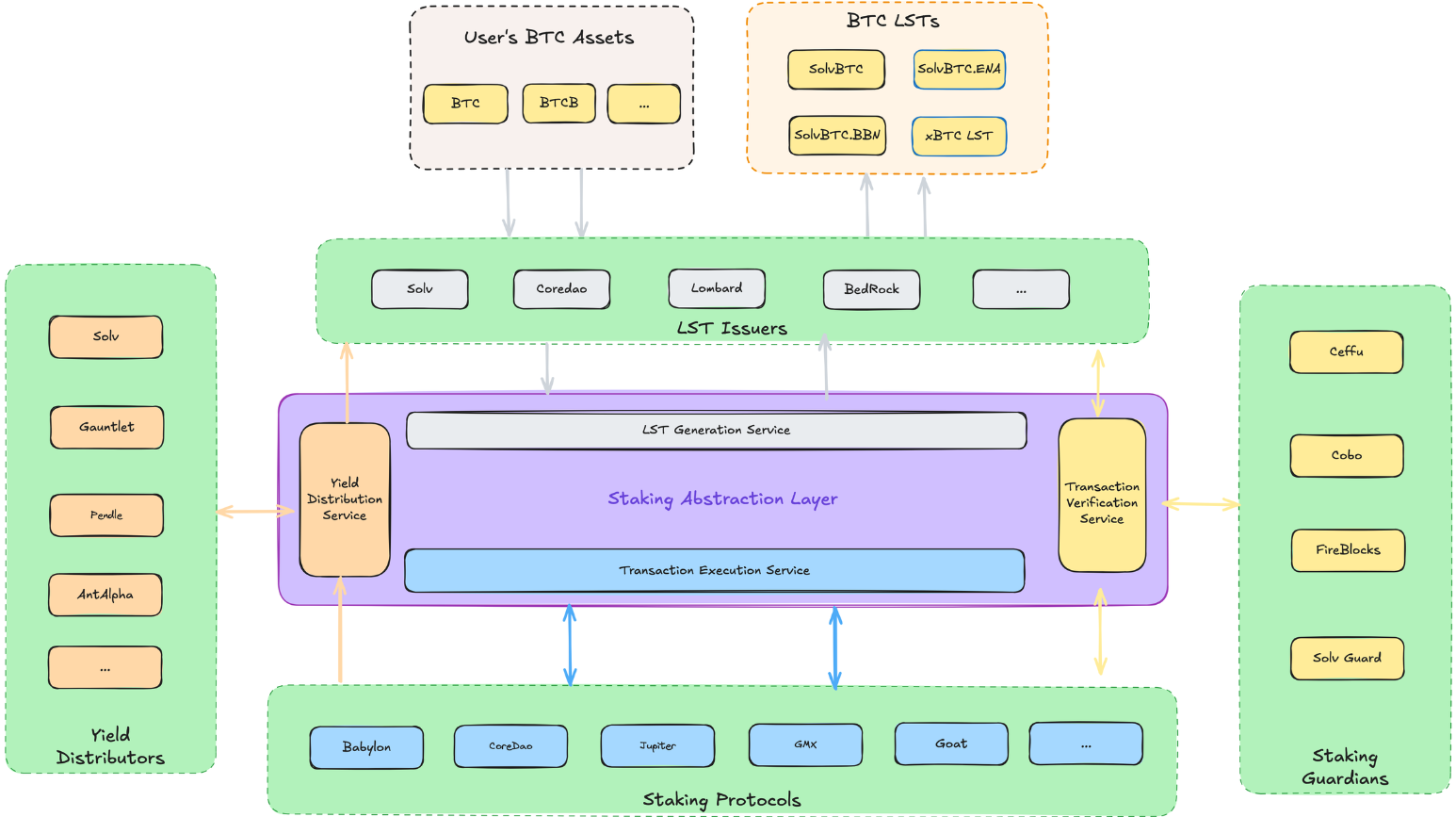

The Staking Abstraction Layer (SAL) is Solv Protocol’s core infrastructure. It aims to abstract the complexities of staking Bitcoin across multiple ecosystems and presents a unified interface for Bitcoin holders.

But why build the SAL? Unlike Ethereum the BTC network doesn’t have an official staking mechanism, because of this the staking process relies on a number of different independent stakeholders. Therefore a unified platform is beneficial in order to standardise the process to ensure transparency and security across the stack for Bitcoin stakers. A coordination layer such as the SAL will allow end users to gather yield with full transparency around any risks or additional security assumptions being taken on in the process while still remaining efficient.

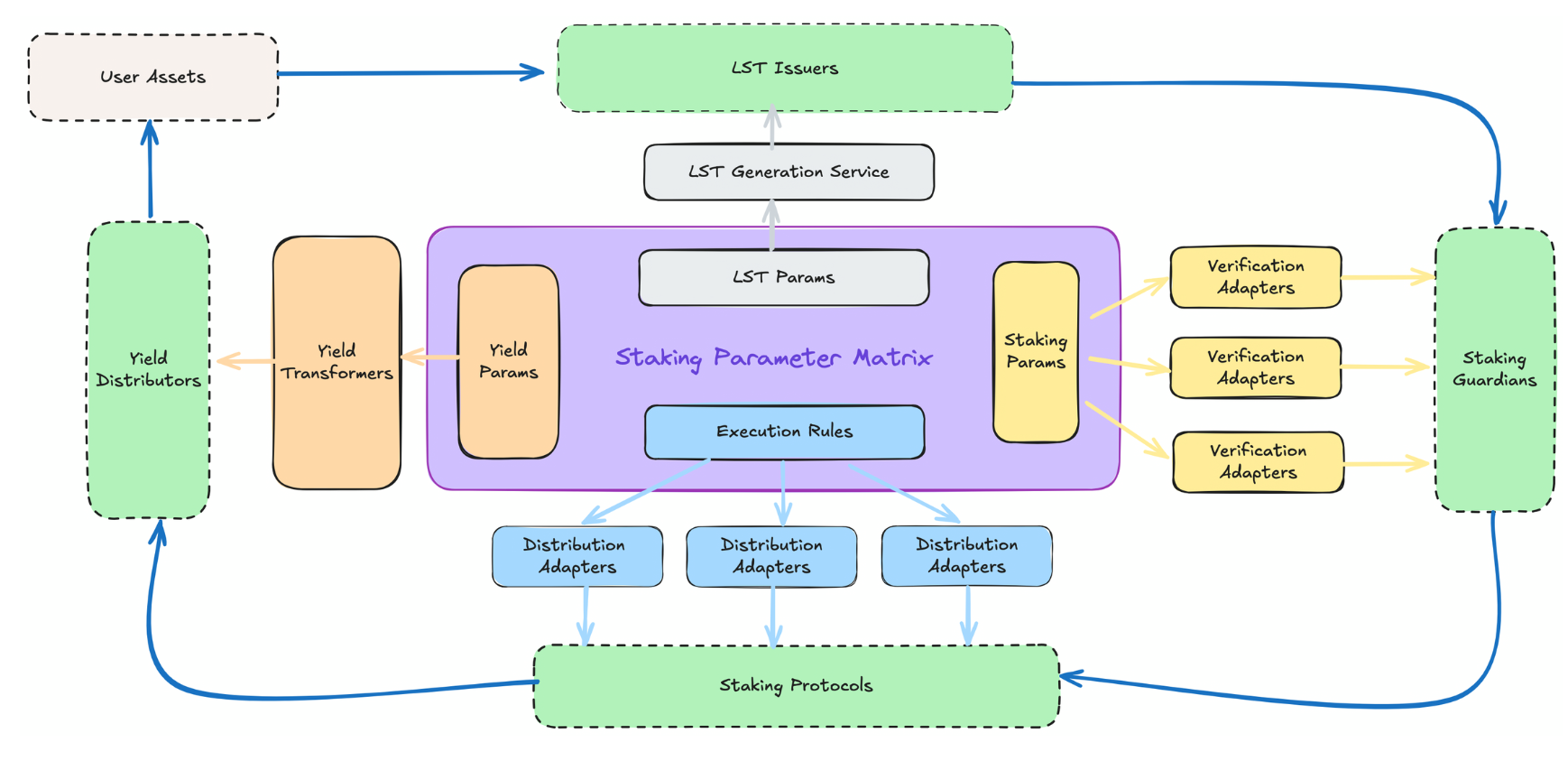

Solv’s SAL is being built with a modular architecture allowing BTC staking protocols to interact with the layer through its staking parameter matrix (SPM) which defines all of the key transaction rules, validation criteria, and yield calculations. Such an architecture allows for a maximally efficient system while maintaining a high level of security through the SPM system.

The end result is a simplified all in one platform for users that allows them access to a diversified stream of yield on their BTC whether it’s through restaking rewards through a platform like Babylon, validator rewards from securing a Bitcoin layer 2 such as Core or DeFi opportunities such as Ethena & Jupiter.

Looking Forwards

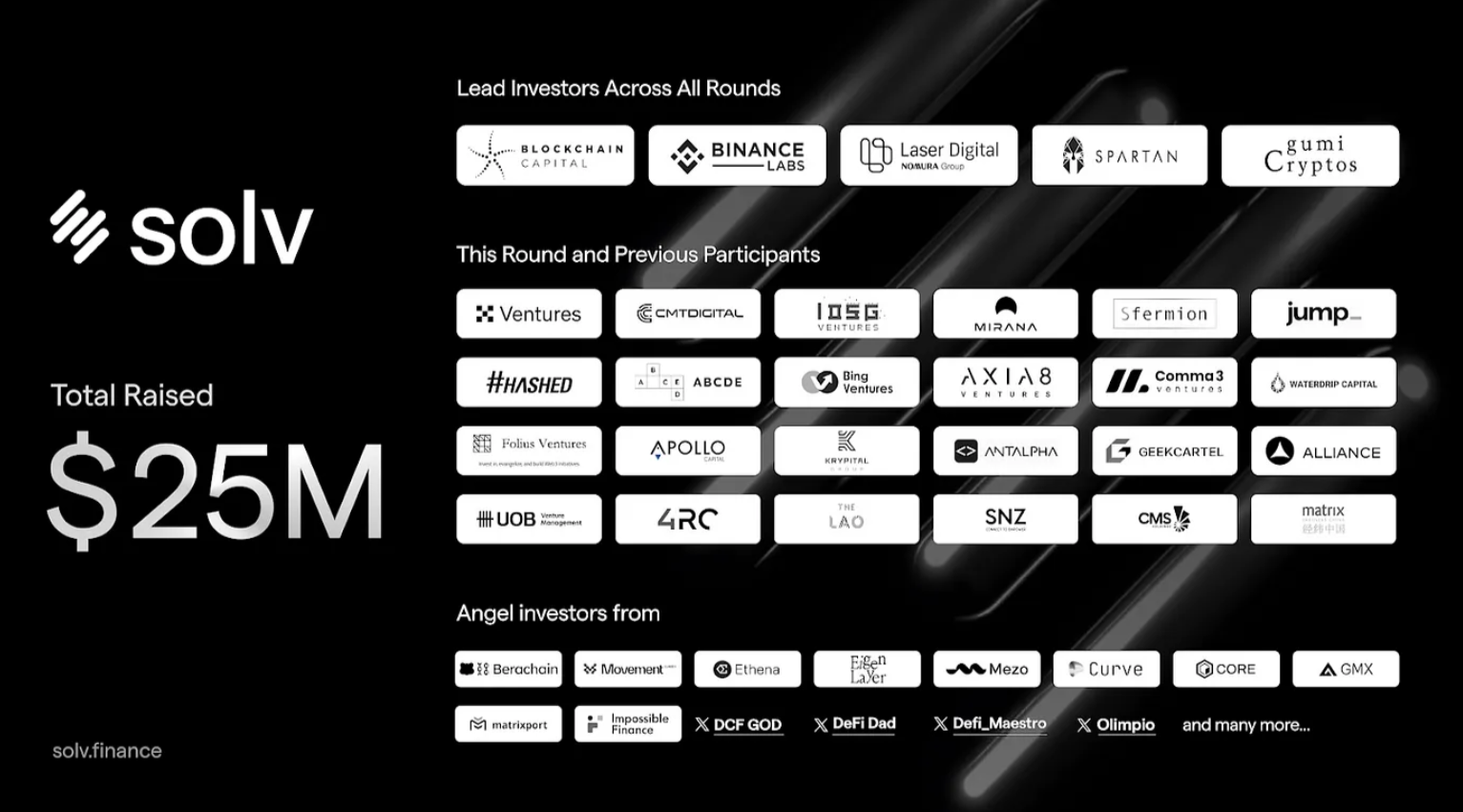

Bitcoin-related projects have raised more than $100 million in the first half of 2024, signalling growing interest in Bitcoin-driven DeFi. I think this trend will continue into the future and Solv is well positioned to capture this future growth as the industry leader in Bitcoin yield opportunities. Solv’s significant TVL, network effects and proven ability to capture the best yield opportunities for its community will continue to drive its future success. As of mid October Solv has also successfully raised an additional US$11 million in a strategic round putting it in a strong position as it looks to advance its Staking Abstraction Layer.

Disclaimer: Solv is an early stage investment of Apollo Crypto

This report (‘Report’) has been prepared for informational purposes only and does not constitute an offer to sell or a solicitation of an offer to purchase any security of financial product or service. This Report does not constitute a part of any Offer Document issued by Apollo Crypto Management Pty Ltd (ACN 623 059 227, AFSL 525760) or Non Correlated Capital (ACN 143 882 562, AFSL 499882), the Trustee of the Apollo Crypto Fund. Past performance is not necessarily indicative of future results and no person guarantees the performance of any Apollo Crypto financial product or service or the amount or timing of any return from it. This material has been provided for general information purposes and must not be construed as investment advice. Neither this Report nor any Offer Document issued by Apollo Crypto or Non Correlated Capital takes into account your investment objectives, financial situation and particular needs. The information contained in this Report may not be reproduced, used or disclosed, in whole or in part, without prior written consent of Apollo Crypto. This Report has been prepared by Apollo Crypto. Apollo Crypto nor any of its related parties, employees or directors, provides and warrants accuracy or reliability in relation to such information or accepts any liability to any person who relies on it. You should obtain a copy of the Information Memorandum, issued by Non Correlated Capital before making a decision about whether to invest in the Apollo Crypto Fund.