categories

All Categories

- Bitcoin

- Centralised Exchanges

- Crypto

- Crypto Asset Volatility

- Crypto Correlations

- Crypto Governance

- Crypto in the Portfolio

- Crypto Valuations

- DeFi

- ESG

- Ethereum

- Investment Highlight

- Regulation

- Security and Privacy

- Social Media Influence

- Stable Coins

- Traditional Finance and Crypto

- Uncategorized

- UNSDG

- Web 3.0

Authors

All Authors

Stablecoins

by David Angliss

Introduction

Stablecoins are the lifeblood of DeFi.

With the recent implosion of UST and the announcement of Aave’s plans to launch its own stablecoin, we thought it timely to provide an overview of the different types of stablecoins within crypto asset markets.

At Apollo Capital, we are constantly transacting, swapping, distributing and harvesting stablecoins to earn yield for our market-neutral funds. Our yield farming covers many activities such as providing liquidity to automated market makers, bootstrapping protocols and decentralised lending.

Outlined below are the different types of stablecoins on the market, Apollo Capital’s views on each and how we allocate between stablecoins within the market neutral portfolios.

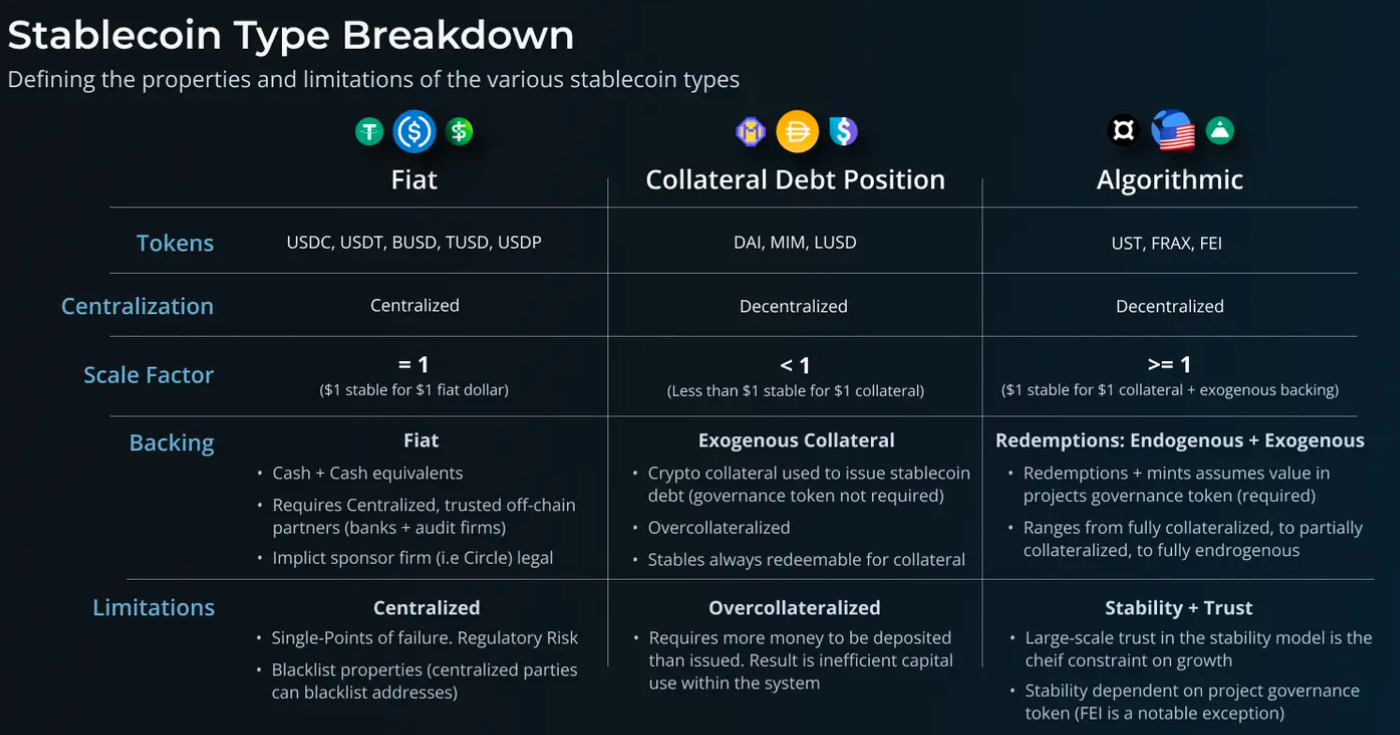

There are three main types of stablecoins:

- Fiat Backed

- Collateralised

- Algorithmic

Source: messari.com

Fiat Backed

Fiat Backed stablecoins are crypto assets that are backed by a corresponding amount of fiat currency. For every 1 US dollar of a fiat backed stablecoin, 1 US dollar of fiat currency is set aside in a bank to back the stablecoin. The stablecoin is therefore a digital representation of the 1 US dollar. Fiat Backed stablecoins were the first to be introduced and are overwhelmingly the largest stablecoins within crypto asset markets.

Fiat Backed stablecoins are centralised crypto assets, governed by central entities that mint the stablecoin on-chain with a corresponding backing of fiat currency, cash equivalents or other market-based investments in traditional bank accounts. The most common fiat stablecoins on the market are Tether (USDT) issued by the Hong Kong company Tether Limited, USD coin (USDC) managed by a consortium called Centre and Binance USD (BUSD), owned by Binance. At the time of writing, these three stablecoins have a market capitalisation of $US139.3B.

Fiat Backed stablecoins are not fully trustless or decentralised. Users must trust that the assets sitting off chain fully back the value of the stablecoins in circulation. Governance by centralised entities leads to regulatory risks, which is less of a concern for decentralised stablecoins.

Crypto asset users must accept an inherent trade off when using Fiat Backed stablecoins. On one hand, Fiat Backed stablecoins are centralised and violate a core principle of crypto assets, decentralisation. On the other hand, the simplicity and superiority of fiat backed stablecoins has led to greater adoption and trading volumes, meaning Fiat Backed stablecoins are used more than other types of stablecoins, by a considerable margin.

Apollo Capital utilises USDT and USDC when engaging with DeFi protocols for yield farming. These fiat stablecoins are the most commonly used crypto assets in the marketplace amongst dApps, users and blockchains. They have the longest track records and are generally responsible for the most consistent yields. Apollo Capital maintains a weighting of 45% – 75% holdings of stablecoins in fiat stablecoins.

Tether USDT Concerns

For many years there have been concerns around the largest Fiat Backed stablecoin, USDT. These concerns were confirmed in October 2021 as Tether was ordered by the CFTC to pay fines totalling US$42.5 million for actions committed in 2016 – 2019. Since then, we believe Tether has taken great strides to improve the transparency and security of the assets backing the stablecoins. An improved regulatory environment has aided in improving their business practices, as securing bank accounts have long been a headwind for the company. The latest concerns revolve around the debt holdings of Tether, with short sellers claiming the company had exposure to the Chinese property company, Evergrande. These allegations have been addressed by the company and the current Reserves Breakdown demonstrates a very strong capacity to redeem all USDT for fiat USD in the short term.

The concerns around Tether are an example of the trade off mentioned above. While the concerns are valid, Tether is still the most widely used stablecoin. Using Tether carries advantages and creates opportunities not available with other stablecoins. Apollo Capital’s views are to proceed with caution. Tether is used within the yield farming strategies, but Apollo Capital constantly manages the extent to which Tether is used.

Collateralised Stablecoins

Collateralised stablecoins are the second type of stablecoin to come to market. As the name suggests, these stablecoins are generated by crypto assets being locked up in an over-collateralised manner, normally above a liquidation ratio of 150%. MakerDAO was the pioneer of this technology by creating the first decentralised stablecoin, DAI. DAI is 1 for 1 pegged to the value of USD. It is decentralised as any user with an Ethereum wallet containing the following ERC20 tokens ETH, WBTC, UNI, LINK, YFI, MANA, MATIC and GUSD, can mint and use DAI. Other leading Collateralised stablecoin projects that have adopted similar mechanisms to Maker are Magic Internet Money (MIM) and Liquity (LUSD). Together all three stablecoins have a cumulative market capitalisation of $US6.8B.

Recently, Aave, DeFi’s biggest borrowing and lending platform, has made a proposal to launch a decentralised, fully collateralised stablecoin called GHO. GHO will be native to the Aave ecosystem and will be available to mint against users supplied collateral on Aave. There will be a diverse set of digital assets that will back the stablecoin, which are chosen by the user. We believe this recent update by Aave validates Collateralised stablecoin’s use case and position in the DeFi ecosystem.

Collateralised stablecoins are sufficiently decentralised, immutable and robust, meaning as long as there is an asset the protocol will accept as collateral, the stablecoin users will always have access to stablecoins. However, whilst the DeFi industry matures, capital efficiency continues to be an issue as certain stablecoin protocols have encountered scaling issues because of the over-collateralisation constraints. An example of a project solving for this pain point is Magic Internet Money (MIM) which has a reduced liquidation ratio buffer. This adjustment to the collateralisation ratio comes with increased risk. Apollo Capital holds approximately 20% to 40% of the stablecoin position in Collateralised stablecoins.

Algorithmic Stablecoins

Algorithmic stablecoins are the newest form of stablecoins to hit the DeFi market. Algorithmic stablecoins are designed to keep a peg by algorithmic minting and burning of a volatile crypto asset and corresponding stablecoins. These stablecoins captivated the DeFi market over the past twelve months, with LUNA and its stablecoin UST. UST grew to the third-largest stablecoin with a market capitalisation of $US18.8B and LUNA rose to the top 10 largest crypto assets with a market capitalisation of $US22B. Algorithmic stablecoins operate on a 1:1 redemptions system whereby stablecoins can be minted by burning the native protocol asset, or the native protocol asset can be redeemed by converting the stablecoin back. Having a 1:1 redemption value introduces a game-theoretic mechanism where if the stable’s value drifts off a peg within the market, there remains always a market to redeem $1 worth of value.

The crux of the algorithmic stablecoins is exactly what makes up the other side of the redemption returned for the stablecoin. The two most popular protocols, Terra’s UST and Frax, both rely on endogenous redemption methods, meaning that the governance token of the project itself is utilised in the process. Reliance on the market value of the protocol’s own governance token, as opposed to the market value of an external asset like ETH, BTC or fiat currency, requires self-reciprocating faith in both the algorithmic stability and the governance token. Reflexivity and volatility are natural enemies of this model. Declining faith in the stablecoin leads to declining faith in the governance token, which then spirals into a lack of faith in the redemption value of the stablecoin. This is exactly what occurred with LUNA / UST in early May, resulting in the implosion of both assets. For a full synopsis of this collapse please reference our article LUNA & UST Update of Events.

Algorithmic stablecoin protocols can have different degrees of collateralisation too, giving the assets different risk profiles. For example, UST which was the largest algorithmic stablecoin did not require collateral to be locked. FRAX, on the other hand, is partially collateralised, with roughly 85% of supply backed by TVL-contributing collateral (this ratio is floating). Algorithmic stablecoins are the most immature and riskiest stablecoins. Apollo Capital has lost faith in Algorithmic stablecoins and is in the process of eliminating the last <5% exposure as locked positions become liquid.

Percentage Breakdown of the Three Types of Stablecoins

Total Stablecoin Growth Over The Past Two Years

At Apollo Capital, we are confident stablecoins will eventually reach a trillion-dollar market value collectively as they continue to play an important role in the crypto ecosystem through providing decentralised insurance, prediction markets, savings accounts, decentralised exchange trading pairs, credit and debt markets, remittances, and more. While there are different approaches to creating a decentralised stablecoin, ultimately the market will decide which ones will emerge as the winners.

Apollo Capital remains vigilant as to how we can profit from generating yield from stablecoins, as well as taking long positions in crypto asset projects that benefit from increasing stablecoin adoption.