categories

All Categories

- Bitcoin

- Centralised Exchanges

- Crypto

- Crypto Asset Volatility

- Crypto Correlations

- Crypto Governance

- Crypto in the Portfolio

- Crypto Valuations

- DeFi

- ESG

- Ethereum

- Investment Highlight

- Regulation

- Security and Privacy

- Social Media Influence

- Stable Coins

- Traditional Finance and Crypto

- Uncategorized

- UNSDG

- Web 3.0

Authors

All Authors

Strongest Fee Generating Assets

by David Angliss

Total fees generated is a strong indication of which protocols are supported by actual economic activity. Last week, one of our highest conviction DeFi investments, GMX, achieved a milestone that most crypto assets will never attain. GMX generated more fees in a single day than any other crypto asset. The milestone is particularly impressive as the protocol is only 17 months old.

The table below shows the top nine crypto assets ranked by their total fees generated on the 11th of February, 2023. These crypto assets are fundamentally important to the industry in that they generate sustainable fees and have a real-world use case, demonstrating strong product-market fit.

This list comprises two main categories of crypto assets that Apollo Crypto invests in:

DeFi Assets;

- Decentralised Derivatives Exchange

- Decentralised Exchange

- Decentralised Borrowing & Lending Platform

Layer 1 Blockchains

https://cryptofees.info/ – 11th of February, 2023

Despite differences in fee calculation methodologies, the common among these assets is their remarkable ability to produce substantial fees. It is worth noting that Apollo Crypto has a long position in all but one of the assets listed above (SushiSwap).

Below is a summary of the crypto categories and how their corresponding crypto assets generate fees.

Decentralised Derivatives Exchange – GMX

GMX is a decentralised derivative exchange and falls into Apollo Crypto’s ‘DeFi Asset’ allocation. GMX is a spot and perpetual exchange that allows users to trade crypto derivatives to hedge, leverage, and speculate, much like traditional market participants use derivatives. Derivatives markets are often significantly larger than the markets for the underlying assets. It also allows liquidity providers to earn yield from the fees paid by the traders through a revenue-sharing model, meaning that on the 11th of February, approximately $US5.6M would have been shared amongst the protocols staking participants, as seen in the ‘Crypto Fees’ table above.

GMX is a revenue-sharing protocol with two fundamentally different tokens: the GMX token and the GLP token. The GMX token is one of Apollo’s most recent and promising DeFi investments. The GMX token is the platform’s utility, staking, and governance token, while the GLP is the liquidity provider token that consists of a basket of crypto assets. Like Synthetix, GMX is an equity-like crypto asset backed by cash flows.

GMX has been one of the best performers in the DeFi market and among Apollo’s investments throughout 2022. Apollo Crypto entered positions in GMX across both discretionary funds on July ‘22, and has since been staking the GMX token to earn a yield varying between 8% to 25% APY. Its yield-generating properties make it akin to assets that can generate positive cash flows, such as equities in traditional finance, as explained in our “Crypto Assets: What makes them valuable? research report.

The graph below shows Apollo Crypto’s entry into GMX and a chart of GMX’s yield over 2022.

Data source: Price: Coingecko.com, Yield: Defilama.com

Decentralised Derivatives Exchange – Uniswap, SushiSwap, Curve, Balancer

Uniswap, the largest decentralised exchange, generated $US3.6M in fees for the 11th of February, 2023.

Uniswap is a decentralised exchange (DEX) integrated into multiple blockchains that allow users to trade crypto assets in a decentralised, trustless, and peer-to-peer manner without intermediaries. Uniswap enables this trading through ‘liquidity pools’ that exist within smart contracts. Users trade within these liquidity pools by depositing the initial asset in and swapping and withdrawing the desired asset, at an agreed price (this price is determined algorithmically).

Uniswap generates fees by charging a fee for each trade on the platform; these fees vary between 0.05-0.3% depending on the asset. This fee is automatically taken from the trade and is split between the liquidity providers who have contributed to the relevant liquidity pool on Uniswap. The fee is designed to incentivise liquidity providers to provide liquidity to the platform, as they earn a portion of the fees generated by trades executed on the platform.

Uniswap (UNI) is a ‘core’ holding in Apollo Crypto’s two directional funds. Apollo Crypto accumulated a large percentage of the holdings via liquidity mining when Uniswap first launched in November 2018.

Apollo Crypto is exposed to the other two leading decentralised exchanges, Balancer and Curve.

Balancer is an Automated Market Maker (AMM) that allows the permissionless creation of liquidity pools with up to 8 tokens in any ratio. In simple terms, while Uniswap pools consist of two assets, Balancer extended the idea and created a formula for pools of a number of assets with arbitrary weights.

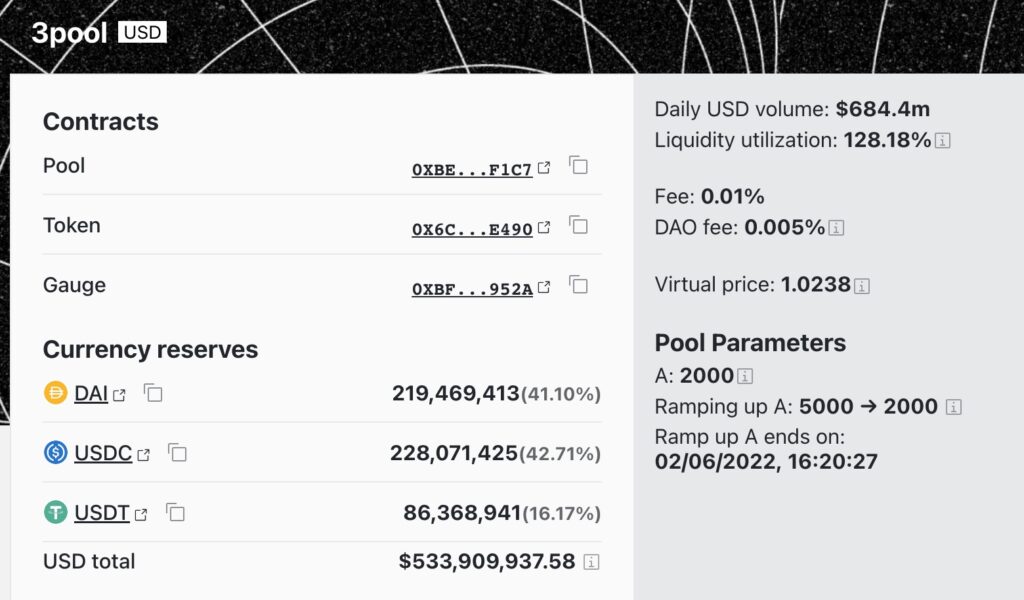

Curve Finance is a decentralised exchange on multiple chains that focuses primarily on trading stablecoins in a trustless and decentralised manner, with the lowest slippage and highest liquidity. An example of how large these liquidity pools can become is shown below with the Curve 3Pool consisting of USDT, USDC and DAI all equating to US$533M at the time of writing.

https://classic.curve.fi/3pool

Decentralised Borrowing and Lending – AAVE

Aave is a decentralised non-custodial lending platform built on the Ethereum blockchain. It allows users to lend and borrow various cryptocurrencies in a trustless and decentralised manner.

Referencing the fee table at the beginning of the article, Aave generated those fees through Lending and Borrowing. Aave charges a fee for lending and borrowing activities on the platform. This fee is designed to cover the cost of executing transactions on the Ethereum network and to support the development and maintenance of the Aave platform.

Defilama.com

Aave, formerly ‘Lend’, was a position accumulated by Apollo Crypto via liquidity mining during the first era of DeFi in crypto and now constitutes a core position in the ACF and ACFF. This is a testament of how focused we were on DeFi applications at an early stage.

Aave earns fees from lending, borrowing, staking, and platform usage fees. These fees are used to cover the cost of executing transactions on the Ethereum network and to support the development and maintenance of the Aave platform.

Layer 1 Blockchains – Ethereum, Polygon, BNB Smart Chain,

Layer 1 blockchains generate fees in a similar fashion. They earn fees by charging users of their platform a variable fee for executing transactions and smart contracts on the on-network. This fee is known as “gas.” The gas fee is typically paid in the ‘native token’ of the platform, e.g. ETH, MATIC and BNB. This ‘gas’ fee compensates the nodes that process and validate transactions on the network. The gas fee varies based on network congestion, and users can adjust their fee to have their transactions processed faster.

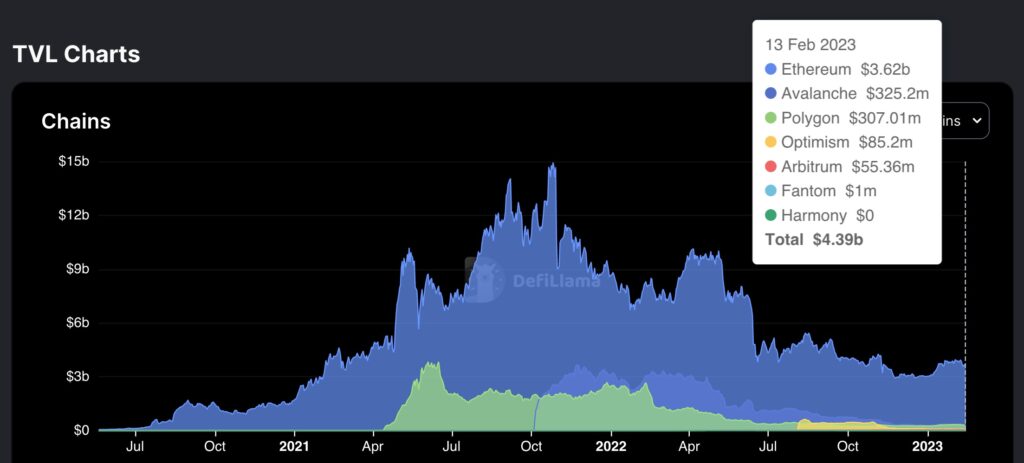

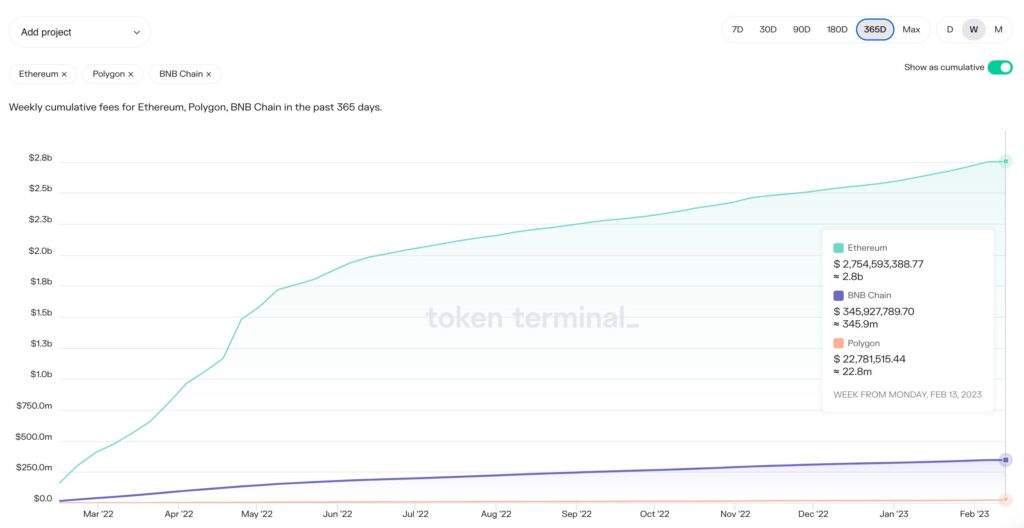

As we evaluate the weekly cumulative fees for Ethereum, Polygon, and BNB Smart Chain over the past year, we observe a striking contrast in their performance. Despite the tumultuous and bearish nature of the crypto market this past year, the Ethereum blockchain continues to demonstrate its capacity to generate billions in fees. On the other hand, we see BNB’s cumulative fees remaining in the hundreds of millions and Polygon’s remaining in the tens of millions.

https://tokenterminal.com/terminal/metrics/fees

In summary, it is worth noting that the cumulative fees produced by cryptocurrency assets serve as a crucial metric in evaluating the protocols with authentic economic activity. A notable milestone was reached on the 11th of February, 2023, when GMX, a DeFi asset, exceeded all other cryptocurrencies in terms of fees generated, underscoring its significance and the importance of on-chain derivative platforms. The eight crypto assets in this article represent the fundamental value as they have sustainable use cases translating to constant fee generation. Out of numerous different crypto asset categories available in today’s market, only two contain the best ‘fee’ generating crypto assets, DeFi Assets, including decentralised derivatives exchanges, decentralised exchanges, decentralised borrowing and lending platforms, and layer 1 blockchains.