categories

All Categories

- Bitcoin

- Centralised Exchanges

- Crypto

- Crypto Asset Volatility

- Crypto Correlations

- Crypto Governance

- Crypto in the Portfolio

- Crypto Valuations

- DeFi

- ESG

- Ethereum

- Investment Highlight

- Regulation

- Security and Privacy

- Social Media Influence

- Stable Coins

- Traditional Finance and Crypto

- Uncategorized

- UNSDG

- Web 3.0

Authors

All Authors

The Bitcoin Multiplier

by Quinn Papworth

What Is The Bitcoin Multiplier?

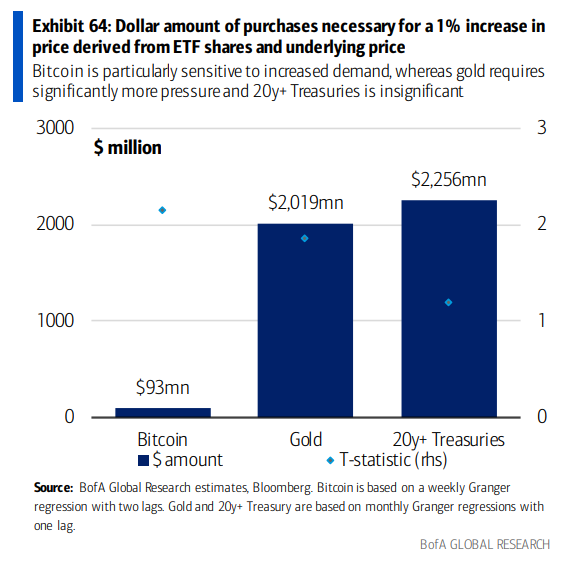

The concept of the Bitcoin multiplier explains the sensitivity of Bitcoin’s market capitalisation to the inflow and outflow of investor funds. In a significant analysis by Bank of America in March 2021, it was reported that Bitcoin exhibits a price sensitivity multiplier of 118x after finding that just US$ 93 million could move the price of Bitcoin 1%. This suggests that for every dollar invested in Bitcoin, the market cap swells by an impressive 118 dollars. The method employed involved assessing the causality of futures ETFs on the Bitcoin spot price, a technique which, although insightful, may present an overly optimistic view. This scepticism arises from the consideration that derivatives form just a fraction of the entire Bitcoin market, compounded by other questionable metrics within the report.

Given these uncertainties, it’s critical to explore alternative estimation methods to pinpoint a more reliable range for the multiplier. Understanding this figure is pivotal as it partly determines the potential ceiling for Bitcoin’s price. This exploration will additionally extend to examining the liquidity of Bitcoin’s supply and anticipated Bitcoin flows, which also influence its market value.

Estimating the Bitcoin Multiplier

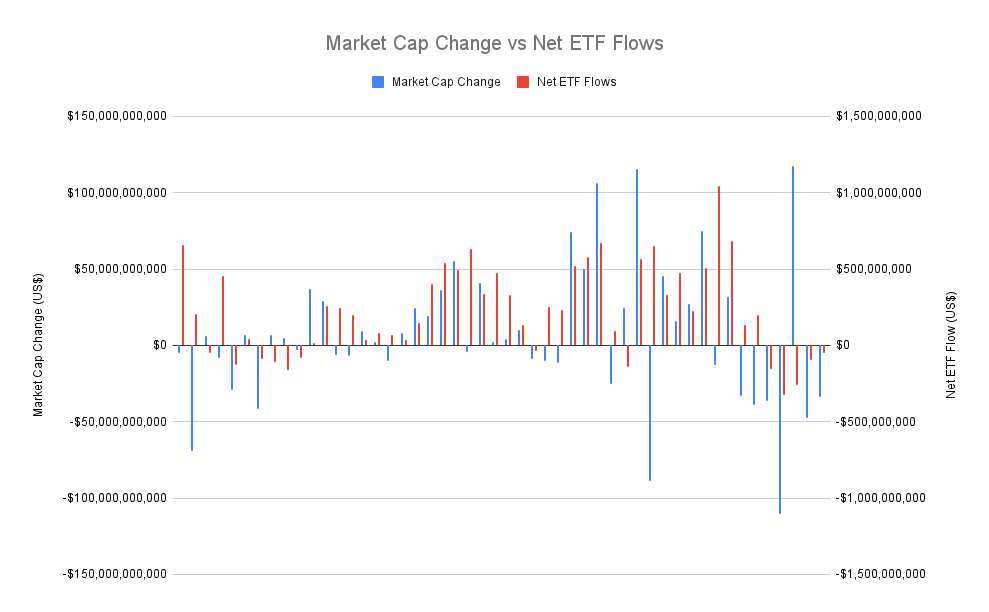

The Bitcoin Multiplier can be estimated by looking at the ETF inflows since inception and the resultant daily increase in Bitcoin’s market capitalisation. Since Jan 11th when the spot Bitcoin ETFs began trading there has been a daily net inflow of US$ 225.5 million in inflows, while the Bitcoin market capitalisation has increased US$ 395.73 billion. As a result a Bitcoin multiplier of 106x can be calculated by taking the average value of each daily market cap change divided by each daily net ETF flow. However it should be noted that the ETF flows and BTC market cap have a modest correlation of 30.4% and as such similar to the BofA report this valuation considers only a fraction of the Bitcoin market, as such we believe this should be viewed as an uncertain estimation for the value of the multiplier.

The endeavour to quantify the Bitcoin multiplier based on purely flows is challenging, due in part to a small data set from the spot ETFs and opaque reporting from cryptocurrency exchanges regarding flows. Despite these obstacles, another feasible multiplier estimation technique can emerge through a derivation of the exchange rate equation sourced from a 2023 study, holding the assumption that Bitcoin does not serve as a primary unit of account.

This approach explains that Bitcoin’s market cap is more responsive to investment holding fluctuations when Bitcoin is less utilised for payments. In simpler terms, as Bitcoin becomes more of a long-term store of value—thereby becoming more illiquid—the multiplier is likely to ascend. This theory is bolstered by the observable positive correlation between cryptocurrency exchange outflows and Bitcoin’s price.

The practical application of this methodology depends on one key metric, the proportion of Bitcoin used for payments, a difficult metric to ascertain. Drawing on a 2022 Federal Reserve study, which found that cryptocurrencies accounted for 2% of U.S. payments, and applying this speculatively to Bitcoin, we can infer a 58x multiplier using the formula (total bitcoin / total bitcoin used for payments). This is after considering that only 18 million out of the total 21 million Bitcoins are still available for use in payments, with the rest being irretrievably lost.

However even this figure is speculative due to questionable data around the payment metrics relating to Bitcoin which we expect to be lower than 2%. Given the complexities involved in accurately measuring Bitcoin’s utilisation for payments, a qualitative approach focusing on the broader implications of Bitcoin’s future and how it will affect the multiplier proves prudent.

Implications for Bitcoin’s Future Price Action

The relationship between Bitcoin’s utility as a store of value and its use in payments is crucial for predicting how the multiplier might evolve. Key factors to watch include:

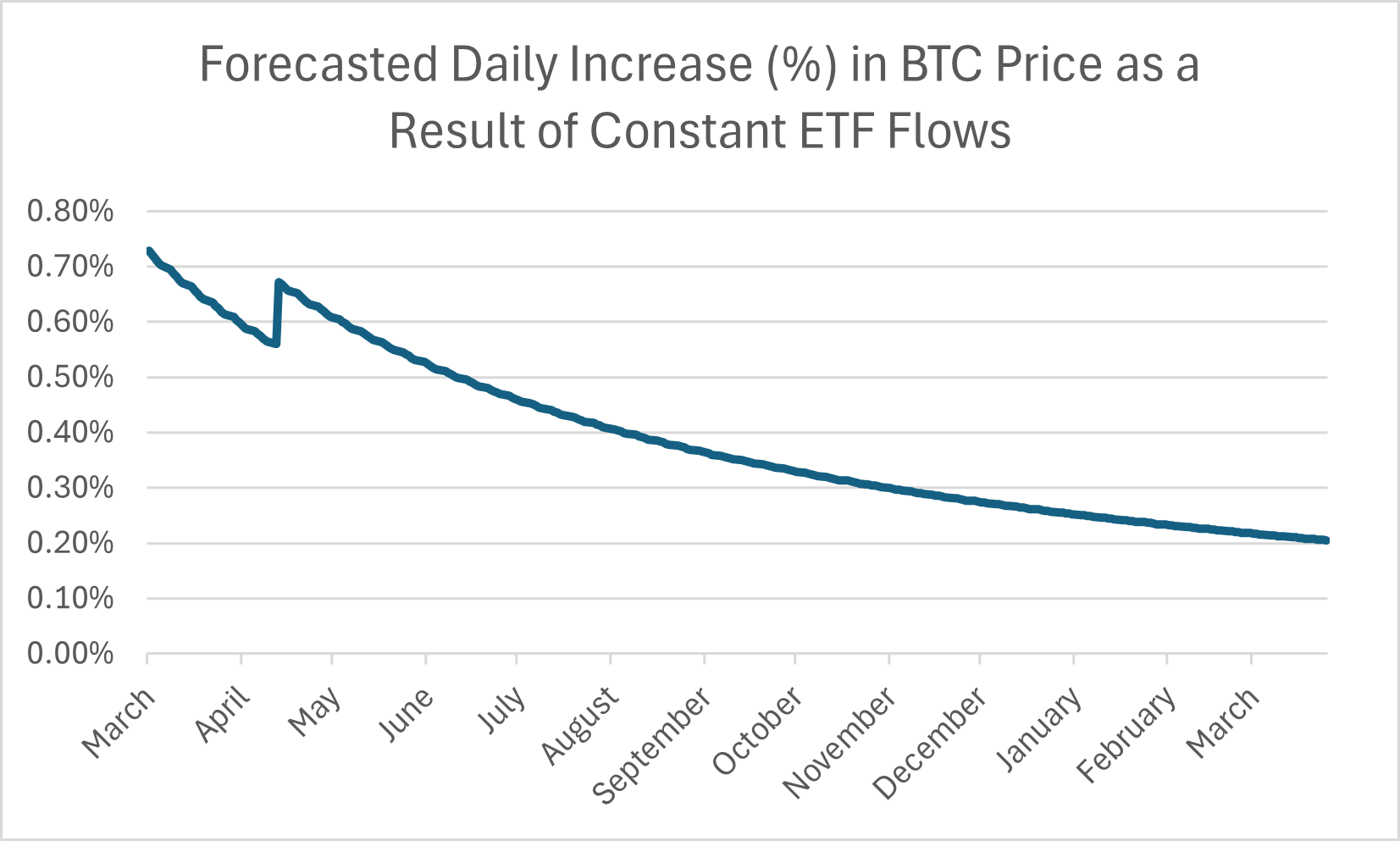

The Spot Bitcoin ETFs: The ETFs have had a wildly successful launch bringing in over US$11 billion in net inflows into Bitcoin in just over two months, underscoring a strong demand. If these inflows persist, especially post-halving, we can anticipate a significant price surge. However, this fails to account for potential multiplier growth as Bitcoin’s liquid supply decreases—a critical consideration given that ETF investors, hailing from traditional finance platforms, are more likely to view Bitcoin as a long-term store of value investment where they will hold it over a long term investment horizon. This likelihood is bolstered by funds like Blackrock and Fidelity now beginning to allocate Bitcoin to their various investment funds. As a result it can be assumed that as flows continue to come into the spot Bitcoin ETFs and exchanges the Bitcoin multiplier will increase as well. This will be important going into the future as if the multiplier and flows remained stagnant the effect on Bitcoin’s price as a result of the flows would gradually plateau as the USD value of Bitcoin climbs.

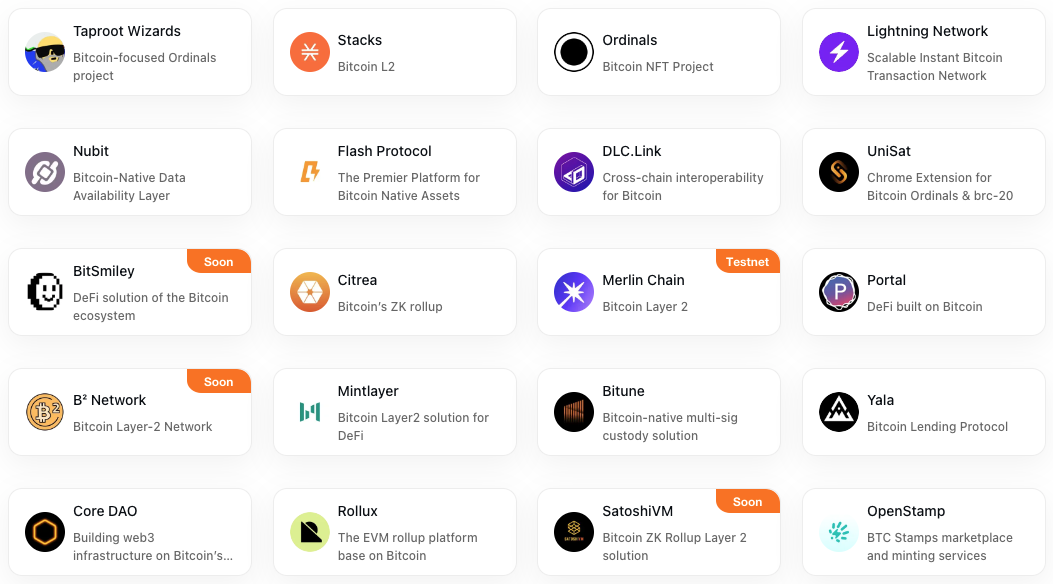

The Bitcoin Ecosystem: Bitcoin has recently been seeing significant growth within its ecosystem with considerable interest in the Ordinals ecosystem and the Bitcoin layer 2 ecosystem. As such it has interesting future consequences for the Bitcoin multiplier. A thriving Bitcoin ecosystem could effectively increase the amount of Bitcoin being used for payments and as such reduce volatility and dampen the multiplier effect. However a Bitcoin ecosystem could also introduce new primitives such as staked BTC which could lock up significant levels of value, effectively increasing the multiplier. As such there is still ample room for payments in Bitcoin to grow given that the inflows towards investment holdings also increases proportionally. As such it is believed that the growth of a Bitcoin ecosystem is net good for the multiplier based on the fact that it improves Bitcoin’s investment thesis by bringing in further use cases and capital efficiency thereby increasing investor sentiment towards holding the asset long term.

In conclusion, the Bitcoin multiplier serves as a measure of Bitcoin’s inherent scarcity, reflecting its sensitivity to the flow of investor funds within its market.This multiplier not only quantifies the immediate financial leverage exerted by investment inflows but also highlights the broader implications of Bitcoin’s liquid supply. We will watch closely for a potential scenario where innsatiable demand meets immovable supply and the Bitcoin multiplier could stand to surge.