categories

All Categories

- Bitcoin

- Centralised Exchanges

- Crypto

- Crypto Asset Volatility

- Crypto Correlations

- Crypto Governance

- Crypto in the Portfolio

- Crypto Valuations

- DeFi

- ESG

- Ethereum

- Investment Highlight

- Regulation

- Security and Privacy

- Social Media Influence

- Stable Coins

- Traditional Finance and Crypto

- Uncategorized

- UNSDG

- Web 3.0

Authors

All Authors

The Era Of The DAO

by Matthew Harcourt

Decentralised Autonomous Organisations

An exciting phenomenon in the crypto world that is currently accelerating is the transition from a central hierarchical structured entity (Web2.0) to a decentralised and flat structured entity (Web3.0). This business structure created as a result is called a Decentralised Autonomous Organizations (DAO). Although DAOs are yet to fully mature (as are most sectors such as DeFi, NFTs and Blockchain gaming), their benefits over traditional structures are starting to be identified: transparency, immutability, autonomous functionality, and democratic voting for decision making. Many of the great crypto projects are moving to more decentralised modes of governance outlined in one of our previous blog posts The Race for Decentralisation.

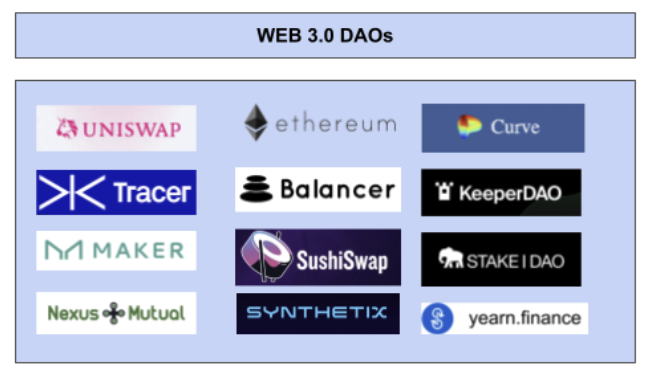

Common DAOs in the DeFi ecosystem. Snapshot.org provides a list of numerous DAOs in the ecosystem.

What is a DAO?

As mentioned above, a DAO is a completely decentralised governance model that an entity will operate under. The following analogy helps explain the concept of a DAO. As Bitcoin was designed as a peer-to-peer currency that removes the middlemen in financial transactions, DAOs are designed as self-efficient entities with all business processes written in the code, thereby eliminating managerial involvement. Examples of DAO business types include; for-profit and non-profits, investor groups, trader groups, Dapp communities, developer teams, DeFi protocol governance bodies, NFT or art collector groups, and many more.

How do DAOs operate?

DAOs are created under a predefined set of rules; these rules are encoded as smart contracts and sit autonomously on the Internet. From time to time, a DAO will also need external intervention in order to perform tasks it can not perform autonomously. These external interventions are performed by trusted users in the DAO’s ecosystem, these trusted users can be project founders or publicly elected ‘officials’. These officials are elected by governance token holders to perform such functions.

Once the rules are established, a DAO enters a funding phase. The funding and distribution of ownership (in the form of tokens) is an essential part for two reasons. Firstly, a DAO has to have some internal property, tokens that can be spent by the organisation or used to reward certain activities within it. Secondly, by investing in a DAO, users get voting rights and subsequently influence the way it operates.

Everyone who bought a stake in a DAO can make improvement proposals for the DAO, creating a democracy for innovative ideas. Furthermore, seeing as DAO transactions and interactions with other protocols or individuals are all recorded on the blockchain, they have 100% transparency, a trait that is relatively uncommon in Web2.0 generation entities.

Source: Cointelegraph

Apollo Portfolio DAO Examples

Yearn Finance (YFI)

The Yearn Finance DAO presents a fascinating case study in how the structure of an active DAO can change over time to facilitate greater operational efficiency and increase value to token holders. Since the approval of YIP-61: Governance 2.0 in late April 2021, Yearn has been transitioning into a multi-DAO structure in order for the protocol development to not be stifled by bureaucracy while maintaining a sufficient level of decentralisation.

Multi-DAO refers to the fluid number of DAO’s that contribute to the protocol in some unique way, in the Yearn governance structure these groups consist of YFI holders (vote on changes to the protocol and governance structure), yTeams (focus on relevant operations) and the Multisig (execute any on-chain decisions & transactions). Synthetix are an early innovator of the Multi-DAO architecture, their success is likely to have prompted Yearn Finance to follow a similar path.

Each yTeam of the Yearn Finance DAO have objectives and discrete powers as defined by the token holders. Examples of yTeams and their powers include yDev (YFI protocol developers), yFarm (Responsible for growing the treasury), yBudget (Spend protocol funds productively) & yTx (Write transactions for the Multisig to eventually act upon). A comprehensive summary of Yearn’s governance and yTeams can be found here.

Tracer DAO (TCR)

In June 2021, Brisbane based Tracer DAO raised US$4.5 million from leading funds and angel investors in the crypto space, including Apollo Capital. The Tracer DAO will be governed by TCR token holders and utilise a diverse selection of ‘initial governors’ to streamline governance in the protocol’s early stages. These governors hold expertise in smart contracts, market making, DeFi protocols, Ethereum layer 2’s, user interface design and more.

We view Tracer’s ‘DAO first approach’ as optimal for venture capitalists in the crypto markets as it facilitates a streamlined and practical approach to governance over a purely digital asset (the Ethereum based derivatives platform that Tracer DAO is developing). We look forward to providing further analysis of Tracer DAO’s derivatives platform in the coming weeks.

Synthetix Protocol (SNX)

The Synthetix protocol is another portfolio position that has been at the forefront of DAO innovation over the past several years. Synthetix is an early pioneer of the multiDAO structure, the success of Synthetix governance has prompted similar protocols such as Yearn Finance to implement a similar approach, as discussed earlier. The Synthetix Protocol has several key governing bodies and artifacts (Synthetix Improvement Proposals) which co-exist to enable the decentralised nature of the Protocol. The key decentralised autonomous organisations (DAOs) are the Spartan Council, Protocol DAO, Synthetic DAO, Ambassadors DAO and the Grants DAO.

The most important DAO in the Synthetix governance structure is the Spartan Council (SC), this governing DAO currently comprises 8 members who are elected for a duration of time by SNX staking participants. The Spartan Council has a relatively significant amount of control when compared to more traditional DAO structures but this level of control allows for greater operational efficiency and satisfies the governance demands of the SNX token holders.

View governance proposals for major protocols here: https://snapshot.org/#/

NFT DAO Example – PleasrDAO

In March 2021, the auctioning of pplpleasr’sUniswap V3 teaser video for charity culminated in the last minute creation of one of the most unique DAO’s in the crypto space. The PleasrDAO was formed and funded in under 36 hours and proceeded to buy the up-and-coming digital animator’s NFT for 310 ETH (US$525,000 at the time). PleasrDAO was funded by well known project founders & investors and continues to acquire high-end digital art. The story of PleasrDAO demonstrates the trustless and permissionless possibilities of DAO’s in the acquisition and ownership of digital assets.

We view DAOs as a paradigm shift in organisation architecture that allows for greater transparency, immutability, alignment of stakeholder interests and value capture for underlying token holders. DAOs allow digital assets to be controlled and maintained by a large community of decentralised stakeholders in an open and permissionless manner. This innovation has been made possible by the technological breakthroughs of blockchain, smart contracts and crypto assets. Our portfolio consists of DAOs that are at the forefront of this innovation and we look forward to tracking DAO developments in the years to come.