categories

All Categories

- Bitcoin

- Centralised Exchanges

- Crypto

- Crypto Asset Volatility

- Crypto Correlations

- Crypto Governance

- Crypto in the Portfolio

- Crypto Valuations

- DeFi

- ESG

- Ethereum

- Investment Highlight

- Regulation

- Security and Privacy

- Social Media Influence

- Stable Coins

- Traditional Finance and Crypto

- Uncategorized

- UNSDG

- Web 3.0

Authors

All Authors

The Ethereum ETF Bull Case

by Matthew Harcourt

In late May Ethereum Exchange Traded Funds (ETFs) were approved in the United States, marking a watershed moment for the asset as it achieves commodity status in the eyes of U.S. regulators. We expect Ethereum ETFs to follow the success of the Bitcoin ETFs capturing roughly US$10 billion in flows over the next 12 months which would potentially see Ethereum at a price of roughly US$8,700.

This approval came as a much welcomed surprise to the market as analysts had estimated the probability of an approval at around 20% only a week before the approval deadline. This late reversal was likely influenced by political pressure, including the Senate’s overturning of the SEC’s SAB-121 act, vocal support for crypto from Republican presidential candidate Donald Trump, and the SEC’s reluctance to face another high-profile defeat against the crypto industry after a series of recent losses. In a previous lawsuit by Grayscale, BTC’s grounds for ETF approval was based on the existence of a Bitcoin futures ETF. Following the same logic Ethereum would be fit for approval as well. As a result, a lawsuit based on this precedent set by Greyscale would’ve likely seen the SEC face another defeat.

Commodity Status

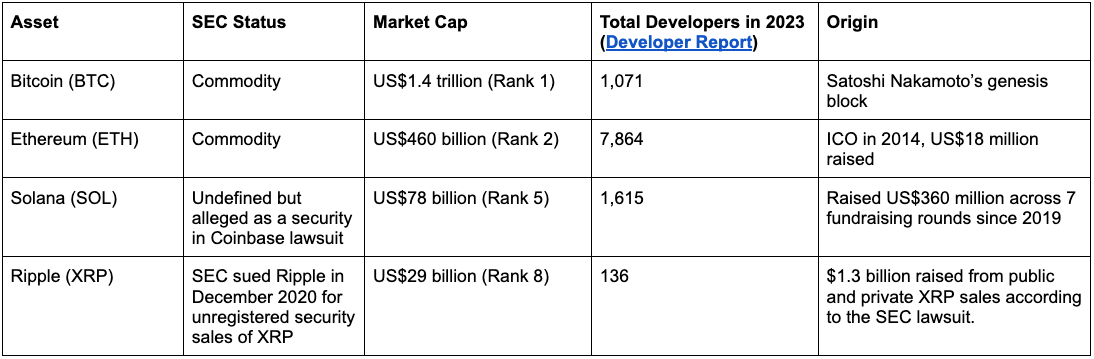

The Ethereum ETFs are defined as “commodity-based trust shares”, this officially classifies spot ETH as a commodity under U.S. law. This classification is immensely significant for a number of reasons.

- Institutional allocators will struggle to allocate outside of these two assets (BTC, ETH) due to risk mandates; and

- No other crypto asset is reasonably close to achieving this status.

We believe the significance of this newly found official commodity status may be under appreciated at the current Ethereum price of roughly US$3,500. We anticipate a substantial influx of institutional buyers into ETH ETFs. This dynamic could create a reflexive flywheel effect, where the positive perception of ETH drives institutional purchases, which in turn boosts ETH prices, further enhancing its perception and perpetuation of the cycle.

Comparing Ethereum to Other Top Crypto Assets

Sources:

Sources:

https://www.developerreport.com/

https://www.binance.com/en-BH/square/post/7689517170361

https://www.reuters.com/markets/us/sec-seeking-2-billion-ripple-labs-chief-legal-officer-says-2024-03-25/

Significant Potential For Traditional Finance Adoption

We see substantial potential for traditional finance (TradFi) adoption of Ethereum, with demand potentially exceeding current market expectations. This growing appetite is evidenced by key opinion leaders in traditional finance becoming increasingly bullish on Ethereum.

- Paul Tudor Jones describes Ethereum as an “industrial digital asset” (Blockworks)

- Billionaire investor Carl Icahn prefer Ethereum over Bitcoin (Vantica Trading)

- Citadel’s Ken Griffin thinks Ethereum will replace Bitcoin (Coinbureau)

- Blackrock launched their BUIDL fund on the Ethereum network

Ethereum Market Narratives

Bitcoin has successfully portrayed itself as a ‘digital gold’ asset worthy of investment from an institutional perspective. While Ethereum is in many ways a more complex asset than Bitcoin, we believe this is actually favourable for Ethereum as traditional investors become more accustomed to the crypto market.

Some compelling Ethereum narratives that may attract institutional ETH ETF inflows include:

- ETH is a productive asset with cash flows as activity from decentralised applications accrue value to ETH;

- Ethereum will become the go-to blockchain for asset Tokenisation, as seen with Blackrock’s BUIDL fund;

- Higher potential value appreciation due to smaller market capitalisation;

- Diversification benefits for allocators who have high conviction on crypto assets; and

- Ethereum uses 99.5% less energy than Bitcoin, satisfying ESG mandates.

Price Set-Up

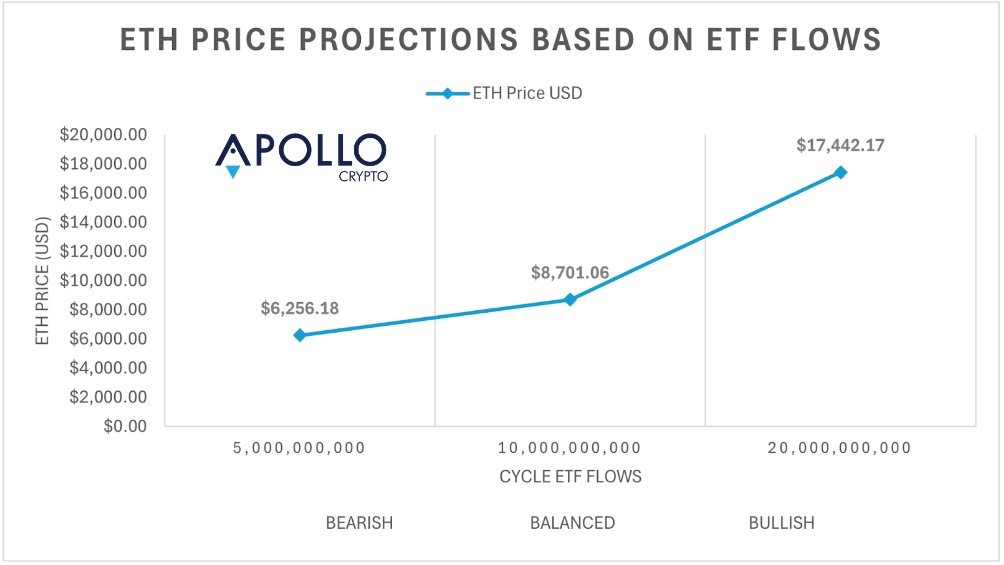

Considering the current catalysts for Ethereum, we believe the market may not have fully priced in the impact of a live and trading Ethereum ETF. Currently priced at around US$3,500, Ethereum is 17% away from its cycle high of US$4,088 in March and 37% away from its all-time high of US$4,800 set in November 2021. This situation could rapidly change if Ethereum ETFs experience positive net inflows similar to Bitcoin’s post-ETF launch. Ethereum’s market capitalisation is currently 32% of Bitcoin’s, if Ethereum captures a conservative 15% of the US$65 billion of Bitcoin’s projected ETF flows and experiences a significant exodus from Grayscale’s ETH.E akin to GBTC, we could anticipate roughly $10 billion in net inflows over the cycle and see an ETH price of roughly US$8,700. This US$65 billion inflow estimate for Bitcoin ETFs was outlined in our December 2023 blog.

The Ethereum Multiplier

If we use a derivation of the exchange rate equation, an equation that measures the ratio between the total number of existing coins and the number of coins that are used to make payments. We can calculate a multiplier for Ethereum of 40x. This multiplier is calculated on the basis of Ethereum’s increased on-chain activity & liquid supply compared to Bitcoin. Although this is an imperfect measure, it upholds the assumption that as store of value holdings decrease so does the asset’s sensitivity to flows. Assuming this multiplier, roughly US$2 billion in net inflows could push Ethereum past its all-time high of US$4,800.

Furthermore, Ethereum’s price maintains a relatively high correlation coefficient of 0.68 with Bitcoin’s price. With Bitcoin ETFs averaging US$140 million in daily net inflows, Ethereum stands to benefit from continued strong support from Bitcoin if these inflows persist. That being said the flows towards Bitcoin ETFs could stand to plateau if significant attention is captured by the Ethereum ETFs.

Unlike Bitcoin, Ethereum is a net deflationary asset, deflating at a rate of -0.182% per year since its transition to proof-of-stake in 2022 and the introduction of the EIP-1559 burn mechanism. This deflationary aspect, combined with the fact that 27.56% of Ethereum’s supply is currently staked and 8% is locked in smart contracts, could lead to a potential supply crunch.

Conclusion

The approval of spot Ethereum ETFs is a landmark moment, elevating Ethereum to commodity status and opening new avenues for institutional investment. This move not only indicates Ethereum’s legitimacy as an asset but also signals a significant shift in the regulatory landscape. As traditional finance increasingly embraces Ethereum, driven by the endorsement of key financial leaders and major institutions like Blackrock, the potential for substantial inflows into ETH ETFs is high. While the market has yet to fully price in these developments, the stage is set for Ethereum to capture significant institutional interest.

This blog post was co-authored with Apollo Crypto Analyst, Quinn Papworth.

This report (‘Report’) has been prepared for informational purposes only and does not constitute an offer to sell or a solicitation of an offer to purchase any security of financial product or service. This Report does not constitute a part of any Offer Document issued by Apollo Crypto Management Pty Ltd (ACN 623 059 227, AFSL 525760) or Non Correlated Capital (ACN 143 882 562, AFSL 499882), the Trustee of the Apollo Crypto Fund. Past performance is not necessarily indicative of future results and no person guarantees the performance of any Apollo Crypto financial product or service or the amount or timing of any return from it. This material has been provided for general information purposes and must not be construed as investment advice. Neither this Report nor any Offer Document issued by Apollo Crypto or Non Correlated Capital takes into account your investment objectives, financial situation and particular needs. The information contained in this Report may not be reproduced, used or disclosed, in whole or in part, without prior written consent of Apollo Crypto. This Report has been prepared by Apollo Crypto. Apollo Crypto nor any of its related parties, employees or directors, provides and warrants accuracy or reliability in relation to such information or accepts any liability to any person who relies on it. You should obtain a copy of the Information Memorandum, issued by Non Correlated Capital before making a decision about whether to invest in the Apollo Crypto Fund.