categories

All Categories

- Bitcoin

- Centralised Exchanges

- Crypto

- Crypto Asset Volatility

- Crypto Correlations

- Crypto Governance

- Crypto in the Portfolio

- Crypto Valuations

- DeFi

- ESG

- Ethereum

- Investment Highlight

- Regulation

- Security and Privacy

- Social Media Influence

- Stable Coins

- Traditional Finance and Crypto

- Uncategorized

- UNSDG

- Web 3.0

Authors

All Authors

The Rise of Crypto Neobanks

by Quinn Papworth

What are crypto neobanks

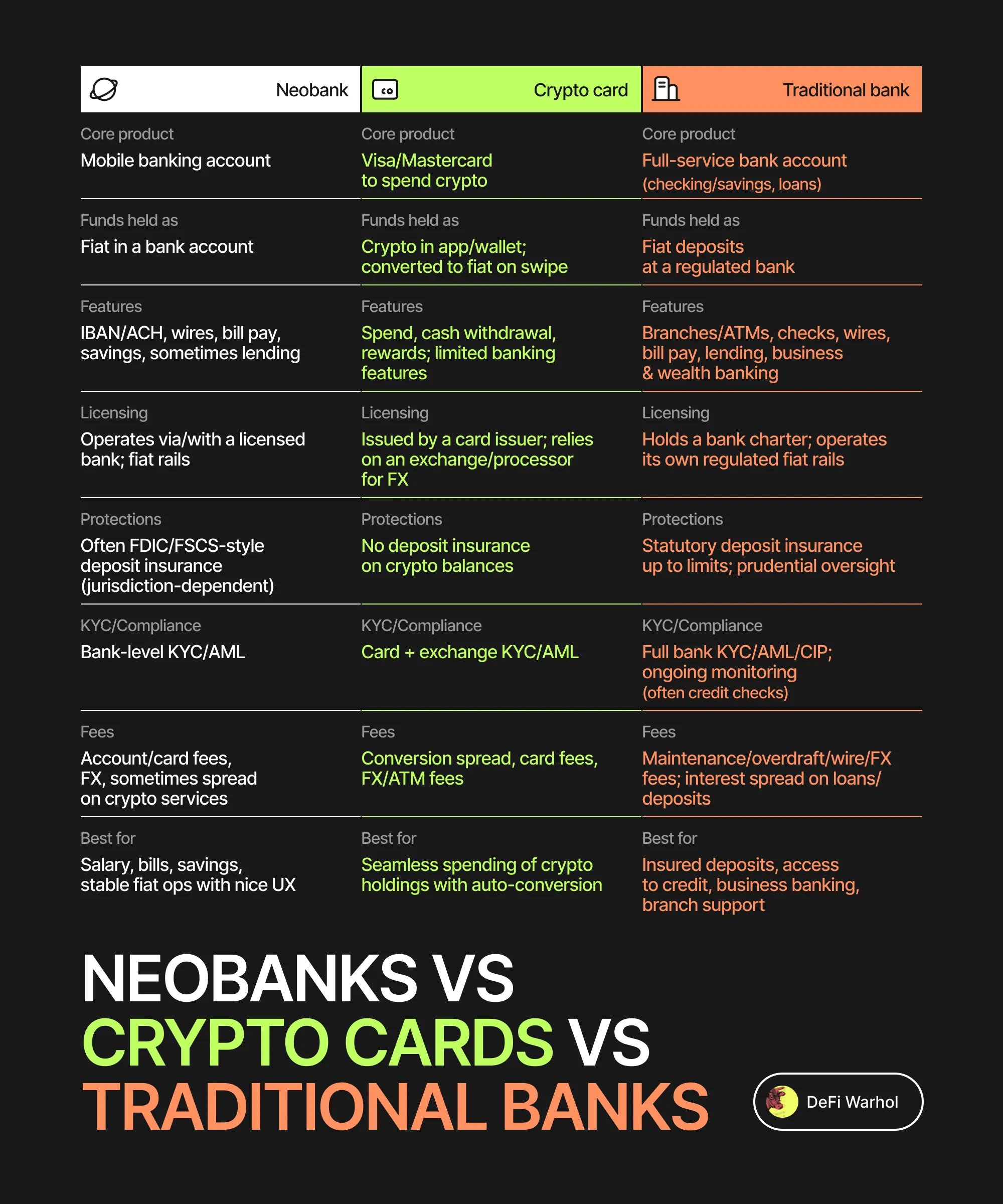

Neobanks are fully digital financial apps that have surged in popularity over the past decade, fueled by consumers’ growing comfort with digital money and platforms, combined with the internet’s explosive expansion and ubiquity. This has enabled neobanks like Revolut to thrive, slashing costs with zero physical branches to deliver genuinely superior products to customers.

Now crypto firms are joining the neobank conversation, aiming to leverage blockchain tech in their platforms offering users faster & cheaper payments as well as highly competitive rates, and honestly it makes a lot of sense. Neobanks are fit to serve crypto’s global user base that already prefer the digital format, and if we add that to that the reality of crypto’s strengths that it:

-

excels at fast, efficient payments.

-

has empowered a fresh cohort of individuals storing their wealth onchain, yet craving seamless methods to spend them in the traditional world.

-

flourishes most in regions lacking reliable access to conventional banking systems.

-(David Christopher, Bankless)

The case for crypto neobanks is strong

Recent Momentum

As a result we have recently seen a swathe of Crypto neobanks and crypto card programs emerging. This ranges from various crypto native protocols such as Ether.fi, Plasma One, Stables, UR, Avici, Metamask etc. as well as traditional neobanks offering crypto solutions. The largest neobank in the world, Revolut, recently joined the discussion introducing 1:1 conversion between USD and stablecoins (USDC/USDT), a move designed to remove friction when moving between fiat and on-chain assets.

This is great for end users, not only are we getting crypto native neobanks but we are seeing competition heat up from traditional neobanks with their existing distribution coming to crypto. Importantly crypto could be a way to make more neobanks profitable because despite their rise in popularity only ~5% of all neobanks have actually reached profitability.

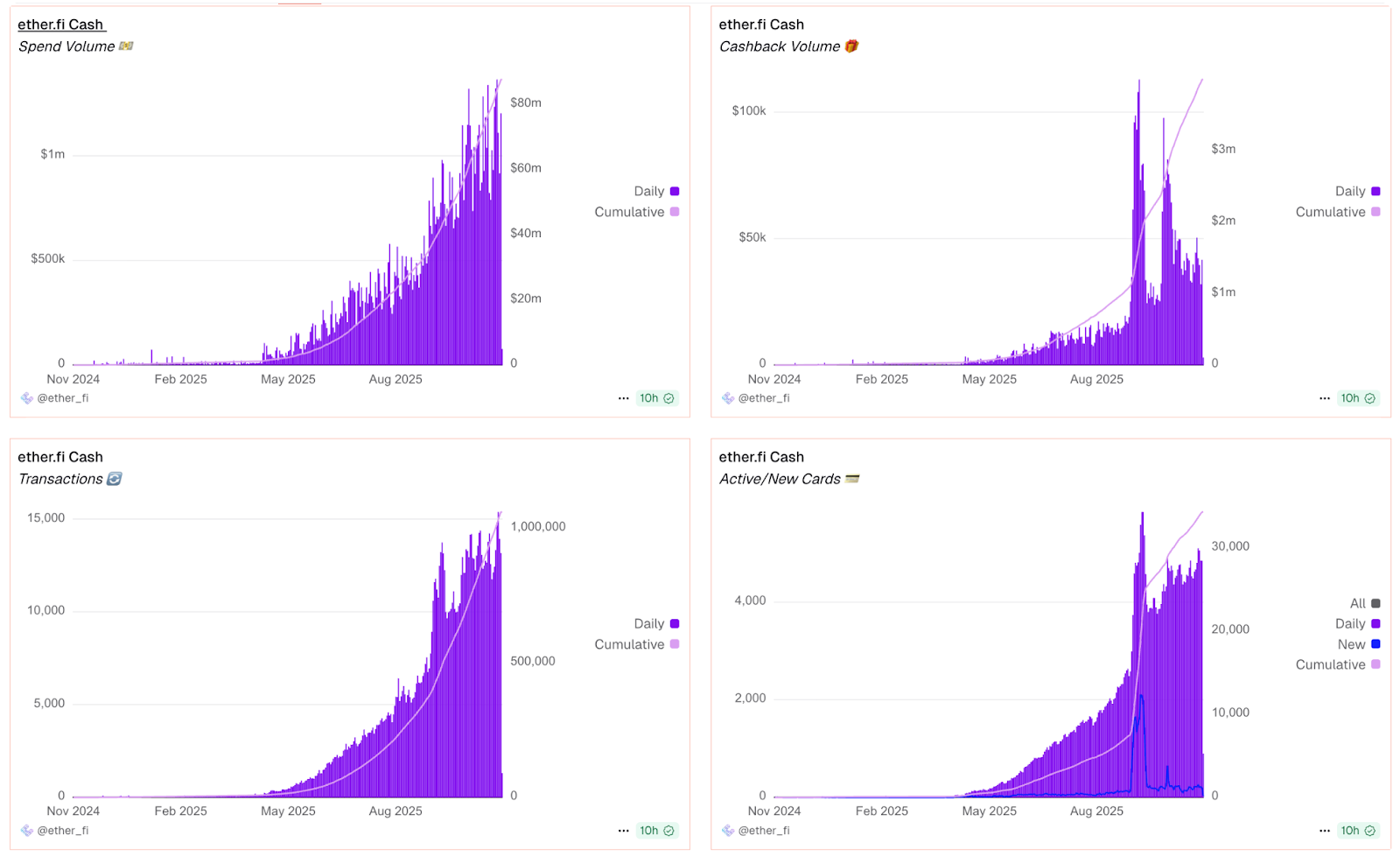

One example of a crypto-native protocol gaining strong traction is Ether.fi’s Cash program, which now records daily spending exceeding US$1 million. The program offers an exceptionally competitive 3–5% cashback on all purchases made with its card, which seamlessly converts users’ crypto holdings at the point of sale. Such user benefits are made possible because crypto neobanks operate with far lower overheads, using self-custody wallets as lean, virtual “bank accounts” that eliminate many of the costs associated with traditional banking infrastructure.

The momentum has been reinforced by the passage of the GENIUS Bill, which has clarified the legal status of stablecoins and eased their integration into the banking system. The move is likely to spur a new wave of initiatives akin to Revolut’s, as stablecoins gain official recognition as financial instruments enabling their potential use in brokerage funding, payments, and interbank settlement.

The future outlook

At present, we’re only beginning to see the true emergence of crypto neobanks. For now, crypto-native offerings, often limited to simple card products rather than full-fledged banking services, remain largely separate from traditional neobanks.

Over time, however, I expect this divide to blur, as established neobanks increasingly embrace blockchain technology to slash operational costs and unlock better, more innovative options for their users. This is especially true after SEC Chair, Paul Atkins’ July speech where he championed the facilitation of “super apps” through horizontal integration of crypto products side by side with traditional offerings.