categories

All Categories

- Bitcoin

- Centralised Exchanges

- Crypto

- Crypto Asset Volatility

- Crypto Correlations

- Crypto Governance

- Crypto in the Portfolio

- Crypto Valuations

- DeFi

- ESG

- Ethereum

- Investment Highlight

- Regulation

- Security and Privacy

- Social Media Influence

- Stable Coins

- Traditional Finance and Crypto

- Uncategorized

- UNSDG

- Web 3.0

Authors

All Authors

The Rise of Digital Asset Treasury Companies

by Quinn Papworth

Inspired by insights from Cosmo Jiang of Pantera Capital

Significant Momentum

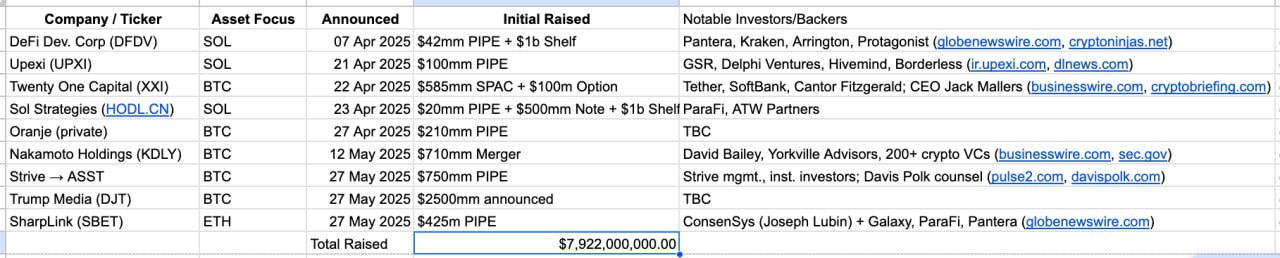

The emergence of digital asset treasury companies (DATs)—firms holding significant cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), or Solana (SOL) on their balance sheets—has reshaped the intersection of traditional equities and digital assets. Pioneered by MicroStrategy (now Strategy), this model provides investors with crypto exposure through publicly listed equities, bypassing the operational complexities of direct cryptocurrency investment. Recently we have seen an influx of companies emulating the Strategy playbook. The sheer amount of headlines surrounding this emerging trend is staggering with more than US$7.9 billion already raised in the last two months alone with many more planned raises in the works.

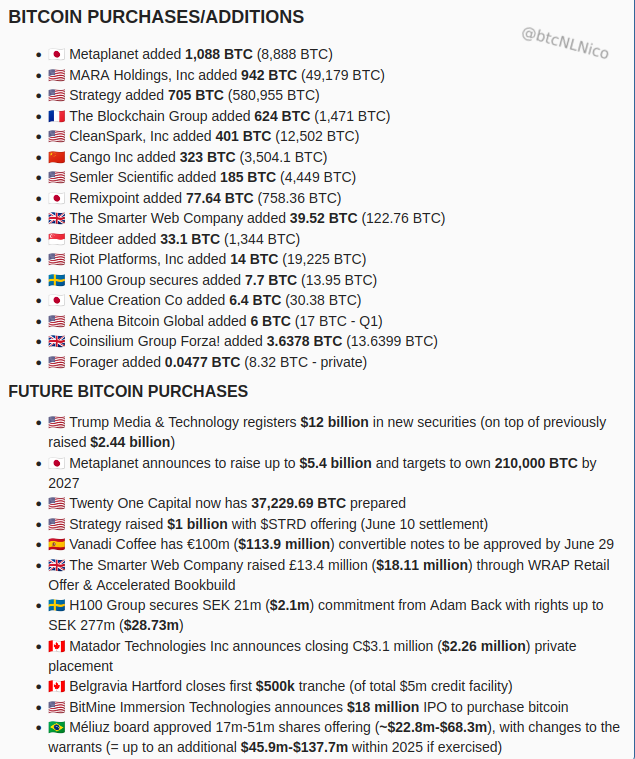

To give you an idea of how much momentum is picking up on this front, last week alone we saw 16 new treasuries formed, 16 companies added Bitcoin purchases worth 4,456 BTC (nearly 50% more than the weekly mining supply output) and 11 firms signaling future acquisitions worth billions, with high-profile registrations like Trump Media ($12 billion in new securities) and Metaplanet ($5.4 billion). Strategy itself raised an additional $1 billion, while Twenty One Capital now holds 37,000 BTC.

So far we have seen this strategy occurring primarily across the three major assets BTC, ETH, & SOL. I think it will remain this way for the foreseeable future and BTC will continue to lead the way however there is merit in ETH & SOL outperforming in this strategy due to their higher inherent volatility, which is conducive to investors using strategies to harvest volatility and the resultant demand for debt.

What’s Driving The Momentum?

The DAT model has gained traction across BTC, ETH, and SOL but why is it that we are seeing DATs popping up in abundance all of a sudden?

- Bridging Traditional and Crypto Markets

DATs serve as a conduit for traditional investors constrained by mandates prohibiting direct crypto exposure. By embedding digital assets within equities, DATs enable access to crypto markets through familiar debt and equity structures, effectively acting as a form of regulatory arbitrage. This addresses pent-up demand from allocators who are still sidelined from crypto exposure due to the operational complexities of crypto native infrastructure (wallets, exchanges, smart contracts etc). - Favorable Regulatory Shifts

The regulatory landscape is evolving rapidly. The U.S. Senate’s recent passage of the GENIUS bill signals growing guidance towards regulatory clarity, a stark contrast to the anti-crypto sentiment of prior years. Crypto is increasingly entering mainstream financial discourse, and anti-crypto stances are becoming politically untenable, particularly among younger voters. This environment supports DATs by reducing compliance risks and fostering confidence for operators. - Cost-Effective Leverage

DATs offer a compelling alternative to traditional leveraged crypto exposure. Unlike perpetual futures markets, where high funding rates erode returns, DATs like Strategy can finance debt at low rates (0–10%) to acquire digital assets. This efficiency contributes to premiums over net asset value (NAV). As Cosmo Jiang of Pantera Capital notes in an example, “If you buy MSTR at two times NAV, you acquire 0.5 BTC per share instead of 1.0 BTC via spot. However, if MSTR grows its Bitcoin per share by 50% annually (last year: 74%), by year-end two, you hold 1.1 BTC—outpacing spot purchases.”

The Outlook For DATs

While the long-term future for DATs is hard to predict, in the medium-short term while demand for digital assets is high they represent an interesting dynamic for the industry. Unlike their ETF counterparts, DATs are effectively one-way-funds that are locking up supply of digital assets for the long-term. As such when combined with the strong flows we have seen from the ETF products it is clear that the current buyers of Bitcoin far outweigh the amount of BTC hitting the market through miner selling pressure.

That being said, DATs aren’t immune to risk, some of the key factors driving the current structure of DATs is BTC’s price, demand for the capital raised by DATs to buy digital assets, and the underlying volatility of BTC and DATs equity. As such these should be factors to watch closely when assessing the health of DATs as well as other factors such as compelling leveraged BTC product competitors, growing comfort with crypto-native infrastructure, debt maturities and possible forced liquidations. For a more in-depth look at the Strategy playbook you can refer to this article we put out previously.