categories

All Categories

- Bitcoin

- Centralised Exchanges

- Crypto

- Crypto Asset Volatility

- Crypto Correlations

- Crypto Governance

- Crypto in the Portfolio

- Crypto Valuations

- DeFi

- ESG

- Ethereum

- Investment Highlight

- Regulation

- Security and Privacy

- Social Media Influence

- Stable Coins

- Traditional Finance and Crypto

- Uncategorized

- UNSDG

- Web 3.0

Authors

All Authors

The State of DeFi Yields

by Quinn Papworth

At Apollo Crypto, we have been highly active in the Decentralised Finance (DeFi) markets since their early days with significant involvement in investing in the underlying DeFi infrastructure as well as utilising protocols in yield generation strategies. As such, the Apollo Crypto Market Neutral Fund (ACMNF) has been harvesting yield in DeFi since 2020. Recently, we have seen an uptick in yields as market conditions improve and bullish sentiment returns. As a result, the yields available in DeFi are once again looking attractive to both crypto native and more traditional investors alike. In this blog we will discuss the uptick in yields, the correlation between yield rates and market sentiment, the “risk free rate” in crypto, and the ways in which the ACMNF primarily obtains yield.

Why Are DeFi Yields High?

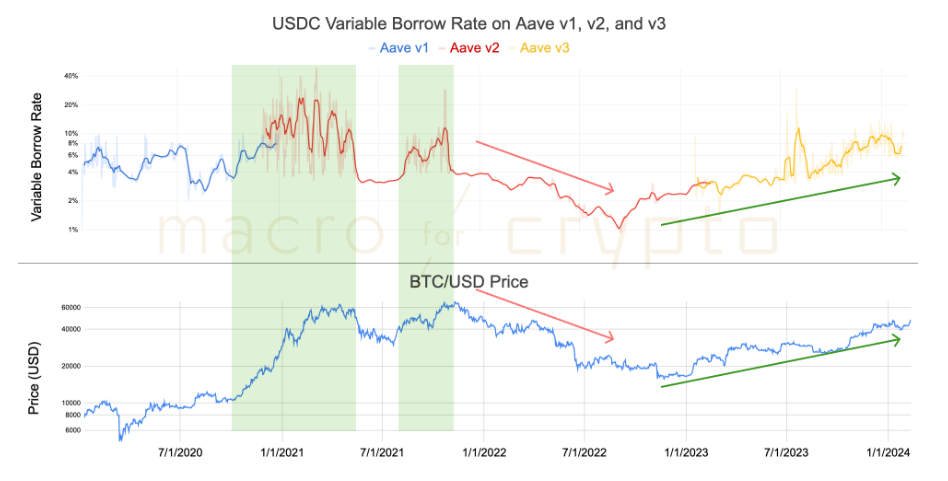

The yields available in DeFi are primarily driven by two factors; the demand for leverage and the prices of crypto assets that are used to incentivise liquidity. With the strong market performance over the past 6 months, both of these factors have been driving yields higher. When volatile assets like Ethereum and Bitcoin trend higher, users borrow stablecoins (USDC) in protocols such as Aave to further purchase more volatile assets, resulting in leverage and increasing the rate USDC depositors earn. We can see this relationship clearly pictured in the chart below.

Since the beginning of DeFi, protocols have used inflationary token incentives to attract liquidity due to the attractive returns that can be generated passively. In the current market conditions where smaller DeFi tokens are multiples off their lows and new tokens are launching at high Fully Diluted Valuations (FDV), teams are able to create higher yields with the same supply of token incentives.

The ‘Risk Free’ Rate of DeFi

Within the DeFi ecosystem, Compound, Aave, and MakerDAO stand as foundational benchmarks, offering returns against which all other investments are measured. Their recognition as virtually ‘risk-free’ comes from their established presence in the DeFi sector and extensive audits proving their reliability and safety. MakerDAO, a leading lending protocol and the provider of DAI, an over-collateralized stablecoin, has recently increased the ‘DAI Savings Rate’ (sDAI) to 15%. This decision was prompted by a surge in bullish market sentiment, which has led to diminished crypto reserves as a result of considerable selling pressure of DAI as investors prefer risk-on assets over DAI in current market conditions. This rate increase therefore aims to bolster DAI’s stability through monetary incentives, enhancing the strength of its collateral reserves and avoid any possible liquidity crunches as some of the DAI collateral reserves are placed in real world assets.

This adjustment introduces a pivotal question to DeFi investors: ‘what investments are going to beat the baseline return earned by depositing USDC/DAI into Compound, Aave, or MakerDAO?’ These platforms not only represent a ‘risk-free rate’ within the crypto domain, but also serve as a gauge for investors to determine the requisite rate of return for assessing alternative crypto investments.

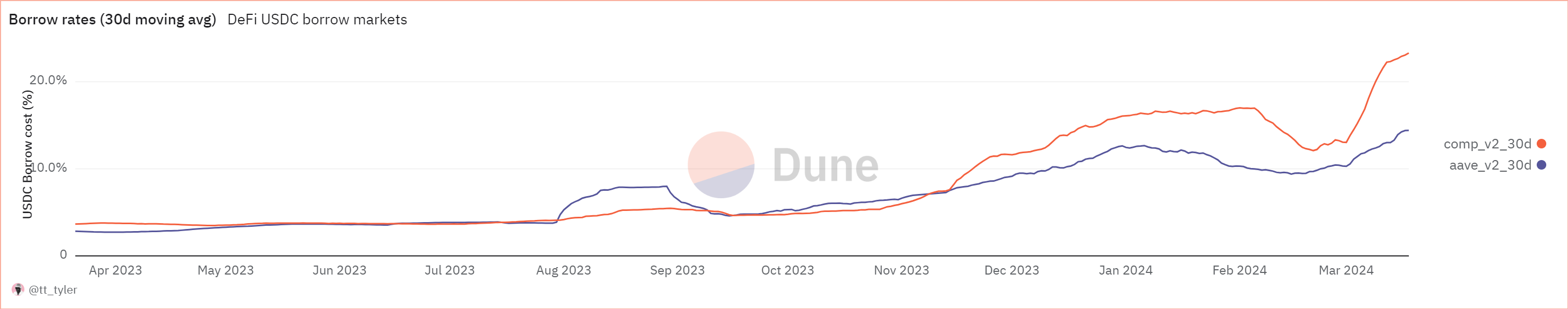

Lending Rates Over Time

Compound and Aave are currently offering an average interest rate of roughly 17-18% to USDC suppliers, indicating strong demand for borrowing. In 2022 and 2023, these rates were considerably lower due to Bear Market conditions. This was a period where DeFi rates were considerably lower than rates seen in traditional financial markets. However, due to the positive change in market conditions, there are currently impressive opportunities to collect high APYs on ‘risk-free’ lending within DeFi. Returns are once again well and truly outperforming the traditional risk free returns of US T-Bills.

How The ACMNF Obtains Yield

Lending & Providing Liquidity to Decentralised Exchanges

The majority of the ACMNFs activity is formed by lending stablecoins to Decentralised Lending platforms as well as by providing stablecoin liquidity to Decentralised Exchanges (DEXs). This straightforward strategy has recently been offering impressive yields. MakerDAO’s lending platform, Spark, is currently offering a base rate of 15% with many protocols offering higher rates of 20-30%.

The Funding Rate Trade

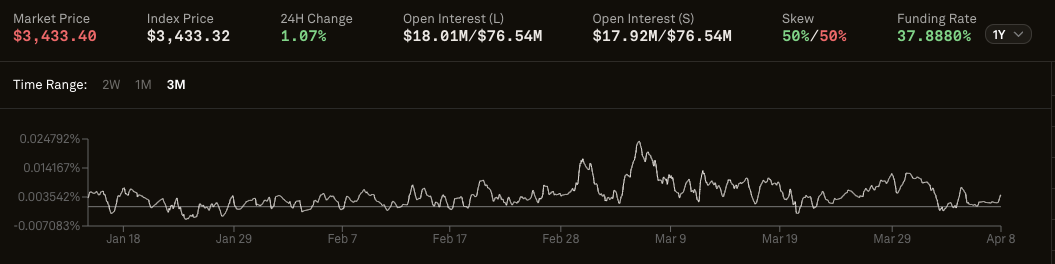

The funding rate is a payment exchanged between sellers and buyers periodically in perpetual futures contracts. This rate aims to ensure the perpetual contract price remains aligned with the underlying spot price, balancing the market by adjusting the cost of holding long and short positions.

Bullish market conditions have caused a positive funding rate due to increased demand from market participants for long positions. This means that buyers who are in long positions are currently paying the funding rate interest towards sellers in short positions. As a result, the funding rate is currently paying a high APY towards investors holding short positions. Kwenta, a decentralised derivatives platform, is currently offering a rate of 37% annualised to short sellers. Therefore, it can be highly profitable to currently hedge your ETH short with an equal spot long ETH exposure making the trade delta neutral while collecting the funding rate in isolation. There are also a plethora of ETH yield opportunities currently on the market including liquid staking and liquid Eigenlayer restaking.

The ACMNF has recently increased its allocation to hedged farming to capture this yield while maintaining a delta neutral position to isolate the fund from capital volatility.

Conclusion

The recent rise in DeFi yields reflects a consistent bullish market sentiment and increased demand for borrowing, particularly in the face of improving market conditions for cryptocurrencies like Bitcoin and Ethereum. The Apollo Crypto Market Neutral Fund (ACMNF) is capitalising on the resurgence of bullish sentiment and improved market conditions to offer investors attractive, delta neutral returns. By leveraging the foundational platforms of DeFi, the fund seeks high yields through lending, liquidity provision, and hedged farming to maximise rewards. DeFi currently offers an attractive opportunity for investors looking to maximise their return from market neutral strategies.