categories

All Categories

- Bitcoin

- Centralised Exchanges

- Crypto

- Crypto Asset Volatility

- Crypto Correlations

- Crypto Governance

- Crypto in the Portfolio

- Crypto Valuations

- DeFi

- ESG

- Ethereum

- Investment Highlight

- Regulation

- Security and Privacy

- Social Media Influence

- Stable Coins

- Traditional Finance and Crypto

- Uncategorized

- UNSDG

- Web 3.0

Authors

All Authors

Three Takeaways From Q2

by David Angliss

Every quarter, we delve into CoinGecko’s quarterly recap, seeking insights into the world of crypto assets. Although the price surges witnessed in the initial months of this year have somewhat subsided, the crypto market has undeniably made steady strides forward with promising tailwinds on the horizon, potentially propelling us into a ‘Bull Market’.

Amidst this backdrop, Apollo Crypto has singled out a few captivating highlights from Q2 that have generated great excitement.

Total ETH Staked Continues To Grow

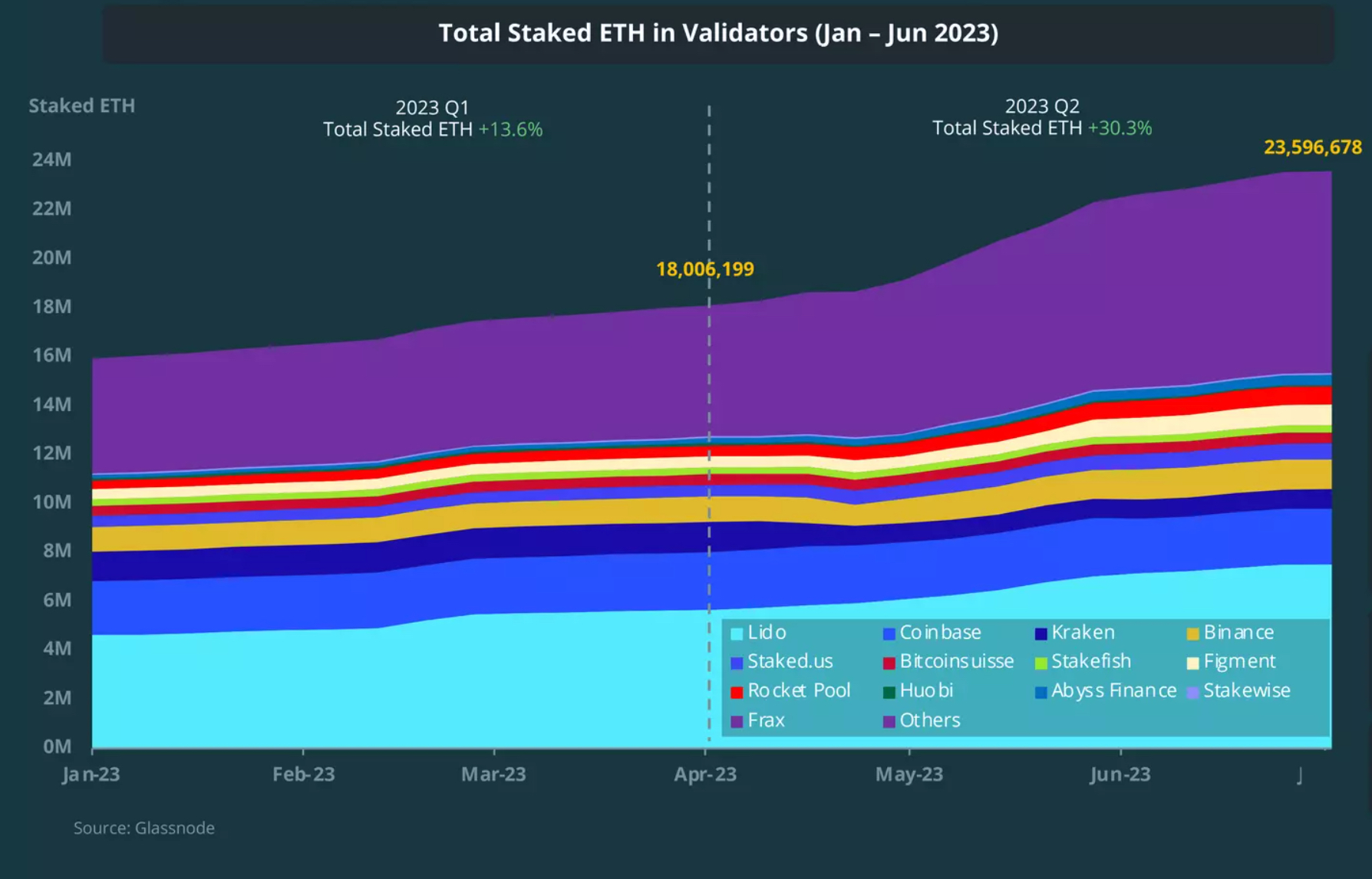

One noteworthy development was Ethereum’s ‘Shapella’ upgrade, which triggered a swift surge in liquid staking derivatives. With the activation of this upgrade, an increasing number of enthusiasts eagerly staked their ETH, resulting in more than 17% of the total ETH supply being committed to staking by the end of Q2. Although concerns linger about security and concentration risks, staked ETH has now evolved into a fundamental DeFi primitive, providing a robust foundation for future innovations and applications in the crypto space.

This visual shows the total amount of ETH staked growing per quarter. Increasing the amount of staked ETH is bullish for the price as this ETH is effectively removed from the supply of ETH available on the market.

Consistent Net ETH Burn

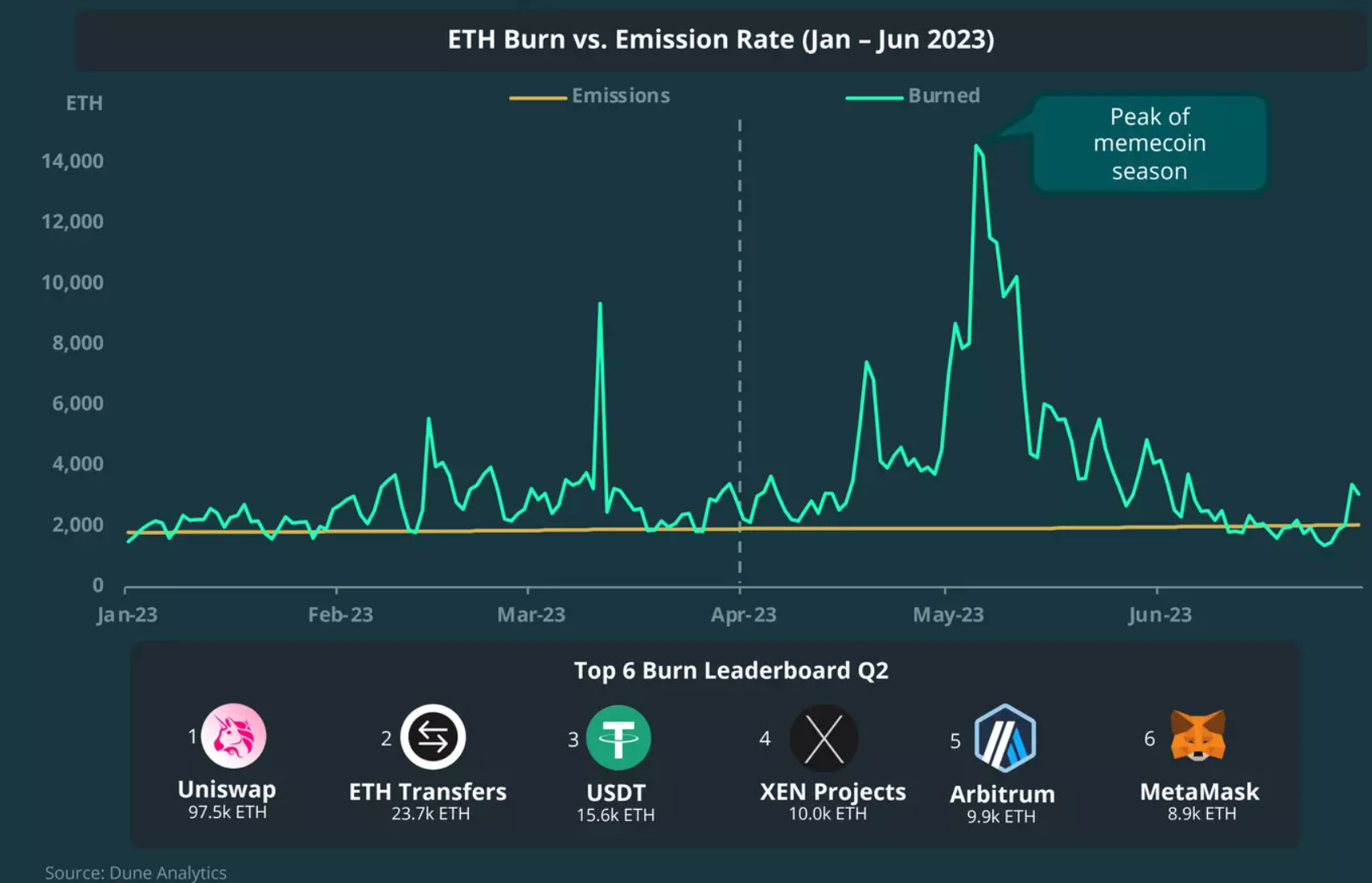

A crucial factor bolstering Ethereum’s price is the net burn/emission rate of ETH. Q2 witnessed Ethereum’s second “net-burn” quarter, largely attributed to the mid-May altcoin season. During this period, a substantial 381,000 ETH was burned and 178,000 introduced to the ecosystem, leaving 203,000 as the ‘net burn’ for the quarter. This translates to approximately US$380 million in ETH removed from circulation and permanently withheld from the market. This scenario mirrors the concept of stock buybacks in traditional finance, effectively reducing the circulating supply and potentially exerting upward pressure on prices.

BTC ETF Incoming

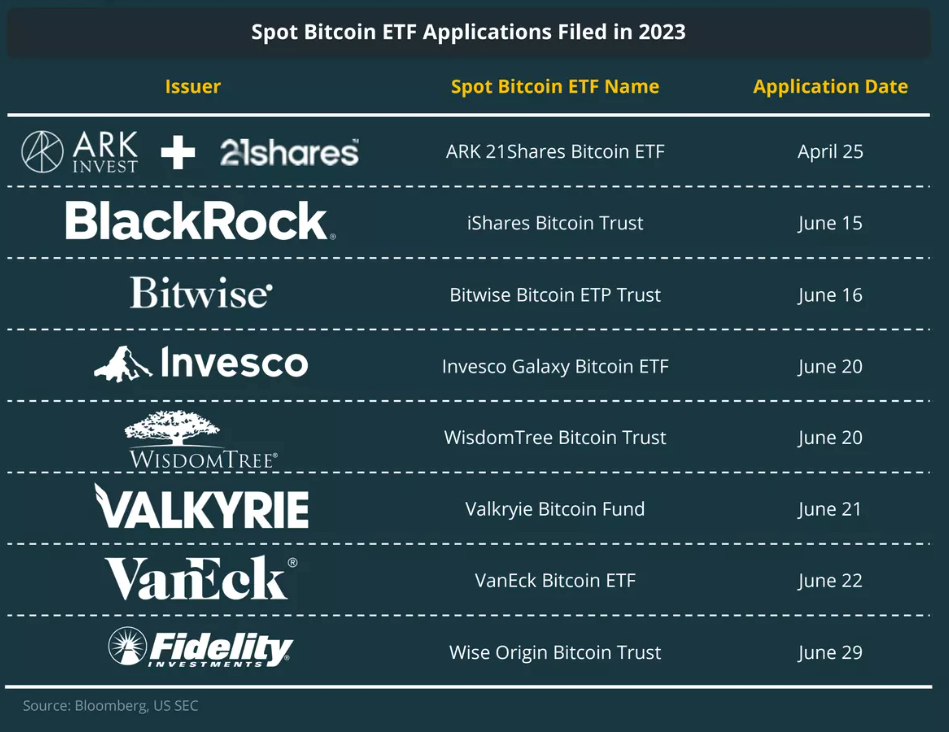

The pinnacle of excitement in terms of crypto adoption arose from the resurgent interest in BTC ETFs (Bitcoin Exchange-Traded Funds). When the market seemed poised for capitulation, a momentous shift occurred with the news of BlackRock, the world’s largest asset manager, applying with the SEC to offer a spot bitcoin ETF. Despite the SEC’s historical reluctance to approve such ETFs, BlackRock’s bold move reignited hope. In a ripple effect, other prominent asset managers, including WisdomTree, Invesco, and Fidelity, expeditiously filed similar applications. While uncertainty surrounds the SEC’s stance on these recent applications from traditional financial players, the news swiftly propelled Bitcoin above the $30,000 mark again.

These applications listed below share one common goal, to be the first US-based spot BTC ETF to market. BlackRock’s success rate when applying for ETFs is extremely high, with the world’s largest asset manager having filed for roughly 550 different ETFs and only being rejected for them once. Read more in an early article we posted here.

As we eagerly anticipate the unfolding of Q3 and beyond, these captivating developments portend a thrilling journey for the crypto asset market, fueling optimism and curiosity among investors and enthusiasts alike.

For the other insights discovered by CoinGecko during Q2 please visit: https://www.coingecko.com/research/publications/2023-q2-crypto-report