categories

All Categories

- Bitcoin

- Centralised Exchanges

- Crypto

- Crypto Asset Volatility

- Crypto Correlations

- Crypto Governance

- Crypto in the Portfolio

- Crypto Valuations

- DeFi

- ESG

- Ethereum

- Investment Highlight

- Regulation

- Security and Privacy

- Social Media Influence

- Stable Coins

- Traditional Finance and Crypto

- Uncategorized

- UNSDG

- Web 3.0

Authors

All Authors

Token Buybacks: DeFi’s Next Act

by Quinn Papworth

A Shift in the Tides

If 2024 was dubbed the year of the memecoin, it seems the dust has finally settled, and 2025 might just be the hangover. The era of financial nihilism is waning as people confront the harsh reality that the so-called ‘fair launch’ memecoins—once touted as a level playing field for retail investors—has morphed into a predatory wolf in sheep’s clothing. On the pump.fun platform, the numbers paint a grim picture: over 5.5 million unique memecoins have been launched since its inception in January 2024, yet only about 1.4% ever “graduate” by reaching a US$69,000 market cap and listing on a decentralized exchange (DEX). Even more telling, as of the time of writing, not one graduated token has been able to hold a US$500+ million market cap, while over 90%+ of these projects collapse within hours, often as insiders execute ‘rugpulls’ to fleece retail investors. Even among the few that do migrate, lasting success is elusive. The hottest memecoins by mindshare, like BODEN, once hyped by seemingly every key opinion leader (KOL), have faded into obscurity, highlighting the fleeting nature of meme narratives.

Degeneracy to Delivery

So, with memecoin liquidity drying up and optimism fading, where will capital flow? My thesis is that after a period of financial nihilism and degeneracy, the pendulum will now begin to swing the other way towards real revenue-generating businesses that actually deliver value to token holders and protocol users. In this view, I am aligned with the Ryan Watkins’ playbook here; “long speculation through infrastructure”. DeFi protocols with strong revenue streams and ironclad control over their distribution layer look like prime candidates to soak up this capital reflux as they have achieved product market fit over multiple cycles.

Is Revenue Alone Enough?

But here’s the caveat. Strong revenue itself isn’t necessarily a dependable moat if it is heavily reliant on external sources. Lets look at Raydium (RAY) as a cautionary tale. From a revenue and token buyback perspective Raydium was highly attractive. However, this quickly changed as pump.fun, which is responsible for more than 30% of the volume on the platform, proposed to use their own in-house AMM DEX instead, stripping Raydium of this deeply positive relationship. Poof, there went the moat.

Market dynamics are seemingly increasingly favouring battle-tested DeFi protocols that consistently generate revenue, as participants increasingly recognize the transience of short-term narratives juxtaposed against the enduring value of select platforms. Over the past five years, a limited cohort of protocols has demonstrated resilience through multiple cycles, establishing a foundation of tangible utility. However, a distinction must be made. Just because a protocol is time-tested and has strong mindshare does not necessarily make it investable.

Value Matters

Take Uniswap’s UNI token as an example. It has been made abundantly clear over the years that UNI serves as just a governance token in name and has no mechanism for value accrual. Ask any UNI holder about the mythical “fee switch”—it’s the carrot that’s been dangled and yanked away so often it’s basically a meme in of itself. Uniswap Labs keeps the equity spoils while the DAO funds projects like Unichain where token holders get zero real ownership and crumbs of value. Mindshare? Sure. Token holder value? Not so much.

Given this premise, how should protocols ensure value accrual for token holders? Token buybacks. This is not to suggest that the absence of a buyback renders a token inherently uninvestable, nor that every protocol requires such a structure. However, for mature, tried and true projects, implementing buybacks can represent a prudent strategy. This approach parallels the behavior of established equities, where firms, having matured beyond their high growth phase, distribute consistent dividends to shareholders.

Maker: The Fundamentals King

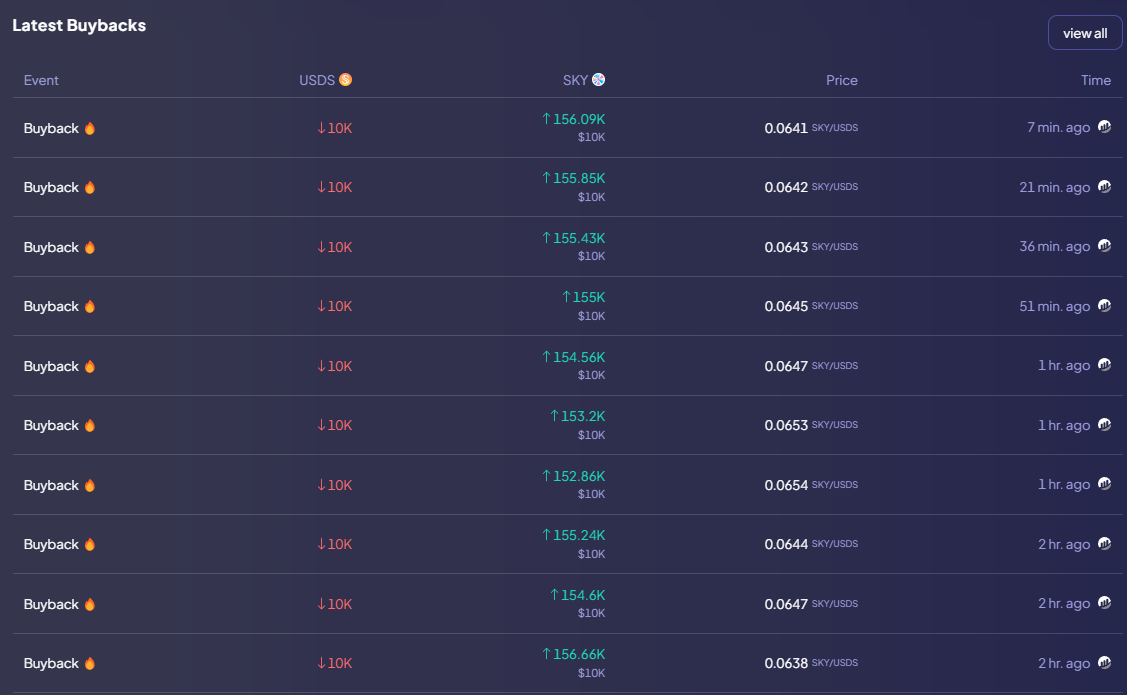

Enter Maker—now rebranded as Sky—the poster child for this thesis. It’s the “savings rate” of crypto: battle-tested, product-market fit locked in, full ownership of its distribution, and churning out steady revenue that it actually shares with token holders. Right now, Maker is buying back US$1 million of SKY daily, set to run for another 50 days until hitting its surplus cap. Founder Rune Christensen has signaled perpetual buybacks from there, fueled by the current rate of US$8 million monthly profits—US$96 million annually. At today’s US$1.3 billion market cap, that’s ~10.9% of MKR’s market cap value scooped up in the next year. Maker stands alone as a fundamentals fortress.

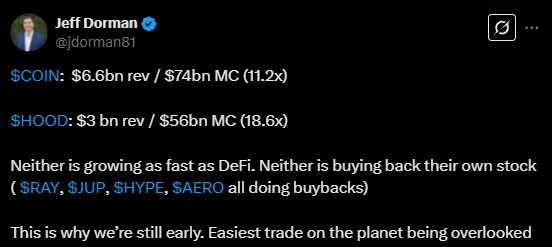

DeFi vs. TradFi

Let’s take a moment to zoom out. Are we fooling ourselves comparing the fundamentals of DeFi to TradFi? Is this all still just speculation with better branding? Time for a reality check. Take Maker (MKR) and stack it against Robinhood (HOOD). HOOD generates US$3 billion in annual revenue with a US$56 billion market cap—a 18.6x multiple. MKR? US$96 million in revenue, US$1.3 billion market cap—a 13.5x multiple. Factor in Maker’s faster growth and aggressive buybacks versus Robinhood’s slower churn and no stock repurchasing, and MKR starts looking comparatively attractive. Sure, Maker’s revenue may be more cyclical—but the numbers suggest we’re not entirely in fantasyland. (credit to Jeff Dorman for this comparison).

The Bottom Line

Revenue-generating protocols, while not the sole determinant of investment merit in cryptocurrency markets, offer a compelling risk-adjusted return profile and serve as robust defensive assets. Increasingly, we observe a wave of protocols activating or contemplating fee-switching mechanisms, a trend likely to accelerate against the backdrop of an increasingly supportive regulatory environment in the United States. This shift signals a maturation beyond crypto’s experimental phase, with stalwart platforms emerging that deliver measurable value to token holders in a transparent manner.

That said, should the global macroeconomic environment tilt toward a more risk-on posture, speculative, high-growth options within the crypto ecosystem may outperform more defensive holdings such as MKR. The potential for elevated returns in such conditions underscores the need for a nuanced assessment of market dynamics beyond the appeal of revenue stability alone. More often than not, crypto investing still remains an art rather than a science.

This report (‘Report’) has been prepared for informational purposes only and does not constitute an offer to sell or a solicitation of an offer to purchase any security of financial product or service. This Report does not constitute a part of any Offer Document issued by Apollo Crypto Management Pty Ltd (ACN 623 059 227, AFSL 525760) or Non Correlated Capital (ACN 143 882 562, AFSL 499882), the Trustee of the Apollo Crypto Fund. Past performance is not necessarily indicative of future results and no person guarantees the performance of any Apollo Crypto financial product or service or the amount or timing of any return from it. This material has been provided for general information purposes and must not be construed as investment advice. Neither this Report nor any Offer Document issued by Apollo Crypto or Non Correlated Capital takes into account your investment objectives, financial situation and particular needs. The information contained in this Report may not be reproduced, used or disclosed, in whole or in part, without prior written consent of Apollo Crypto. This Report has been prepared by Apollo Crypto. Apollo Crypto nor any of its related parties, employees or directors, provides and warrants accuracy or reliability in relation to such information or accepts any liability to any person who relies on it. You should obtain a copy of the Information Memorandum, issued by Non Correlated Capital before making a decision about whether to invest in the Apollo Crypto Fund.