categories

All Categories

- Bitcoin

- Centralised Exchanges

- Crypto

- Crypto Asset Volatility

- Crypto Correlations

- Crypto Governance

- Crypto in the Portfolio

- Crypto Valuations

- DeFi

- ESG

- Ethereum

- Investment Highlight

- Regulation

- Security and Privacy

- Social Media Influence

- Stable Coins

- Traditional Finance and Crypto

- Uncategorized

- UNSDG

- Web 3.0

Authors

All Authors

Traditional Firms Enter Crypto

by Matthew Harcourt

Last week we looked at the major traditional finance asset manager, BlackRock, taking their first strides into the crypto asset industry by filing to launch a Bitcoin Exchange Traded Fund (ETF). The timing of this filing may have come as a surprise due to the recent actions of the SEC, who have launched a regulatory crackdown on crypto asset exchanges and the industry more broadly. Beyond BlackRock, there has recently been numerous other notable developments involving crypto assets and traditional financial institutions that are worth discussing.

Deutsche Bank

Germany’s largest banking institution, Deutsche Bank, has reportedly applied for a digital asset custody licence to the country’s financial regulator, the Federal Financial Supervisory Authority, or BaFin. The bank has shown an interest in entering the industry as early as February 2021 when it stated that it was exploring cryptocurrency custody in order to be able to offer “institutional-grade hot/cold storage solution with insurance-grade protection.”

With large and reputable traditional financial institutions like Deutsche Bank supporting the crypto asset markets as custodians, it is far more likely that institutions will feel comfortable investing in the asset class.

EDX Markets

EDX Markets is a recently launched crypto asset platform backed by Wall Street giants like Charles Schwab, Fidelity and CItadel Securities. The platform has gone live with trading of Bitcoin, Ethereum, Litecoin and Bitcoin Cash. EDX Markets is a non-custodial platform that utilises third party custodians as opposed to in-house custody, which is the current norm when it comes to centralised crypto exchanges. The approach used by EDX Markets is much closer to how traditional financial markets operate today, institutional market participants are able to use EDX through their established prime broker relationships.

EDX Markets is likely to be the first of a new breed of centralised exchange characterised by; owned and controlled by traditional financial institutions, traditional segregation of functions (exchange, clearinghouse, custodian) and limited asset selection due to regulatory pressures.

Dawn Fitzpatrick & Jerome Powell

In a month where the Chairman of the SEC stated “we don’t need more digital currency, we already have digital currency, it’s called the U.S. dollar”, we saw other notable figures within finance come out with vastly different opinions on the future of digital assets. At a Bloomberg Investment Summit in early June the CIO of Soros Fund Management, Dawn Fitzpatrick, stated that “Crypto is here to stay,” and “What’s happened is clearly a setback. But right now I actually think it’s a huge opportunity for the incumbent financial firms to actually take the lead.” The BlackRock filing, Deutsche Bank announcement and EDX Markets latest fundraise all occurred after these remarks from Dawn.

Chairman of the US Federal Reserve, Jerome Powell, also recently discussed crypto assets when testifying in the House Financial Services Committee. Powell mainly argued for the need for strong central-bank oversight in stablecoin regulations. “We do see payment stablecoins as a form of money, and in all advanced economies, the ultimate source of credibility in money is the central bank”, “We believe it would be appropriate to have quite a robust federal role.” Further to this, Powell also said that crypto assets like Bitcoin have shown staying power as an asset class.

WisdomTree and Invesco File For BTC ETFs

Two more U.S.-based asset managers moved to file for spot Bitcoin exchange-traded funds (ETFs) in the wake of the investment giant BlackRock making a similar application last week.

New York-based ETF provider WisdomTree, which currently holds around $93 billion in assets under management, re-submitted an application for their WisdomTree Bitcoin Trust. Invesco, another major investment company with as much as $1.49 trillion under its management as of May 2023, followed with its own application for a spot Bitcoin ETF later last Tuesday. Invesco already have a Bitcon ETF live in Europe.

The move by these two ETF providers to file promptly after BlackRocks application insinuate their is a possibility the SEC may approve the application.

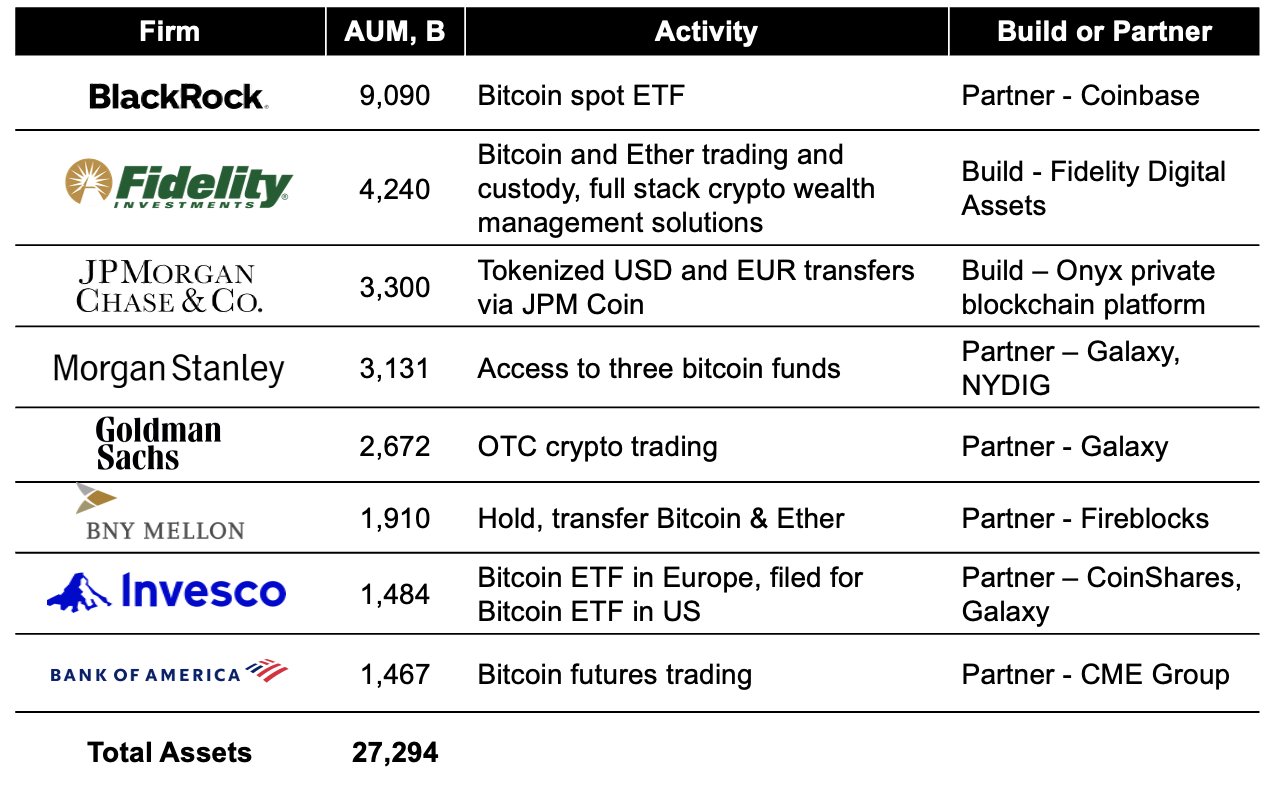

Institutional Snapshot

Further zooming out, it is worth noting that as well as the entities listed above many of the largest financial institutions in the US are actively working to provide access to Bitcoin and crypto assets. This image represents $27.29T of clients assets.

Source: https://twitter.com/Melt_Dem

The crypto asset market can be described as going through a period of consolidation and transformation, we will likely continue to see pressure on existing US-based crypto companies like Coinbase while traditional players enter the market to seize the opportunities created.