categories

All Categories

- Bitcoin

- Centralised Exchanges

- Crypto

- Crypto Asset Volatility

- Crypto Correlations

- Crypto Governance

- Crypto in the Portfolio

- Crypto Valuations

- DeFi

- ESG

- Ethereum

- Investment Highlight

- Regulation

- Security and Privacy

- Social Media Influence

- Stable Coins

- Traditional Finance and Crypto

- Uncategorized

- UNSDG

- Web 3.0

Authors

All Authors

Crypto Has Entered a Golden Age

by Henrik Andersson

Summary

The Golden Age of Crypto is upon us.

With President Trump winning the US election and Republicans securing control in both the Senate and the House it is clearly giving a big boost to the sentiment in the crypto markets.

We believe we are about to enter a golden age for crypto and a DeFi Renaissance. This pivotal fork in the road is likely to lead to new all time highs for several crypto assets in the coming 12 months.

US Election

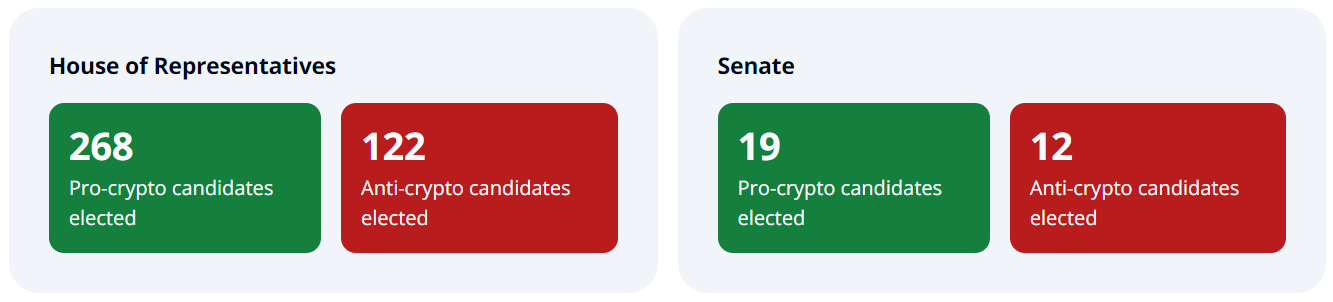

This election marked a big shift in pro-crypto elected officials that is hard to underestimate. Both the House of Representatives and the Senate now have more pro-crypto candidates than ever before. There is zero electoral benefit for any house or senate representative to be anti-crypto today; especially when pro-crypto PAC Fairshake has over $78 million marked to be disbursed for the 2026 midterm elections.

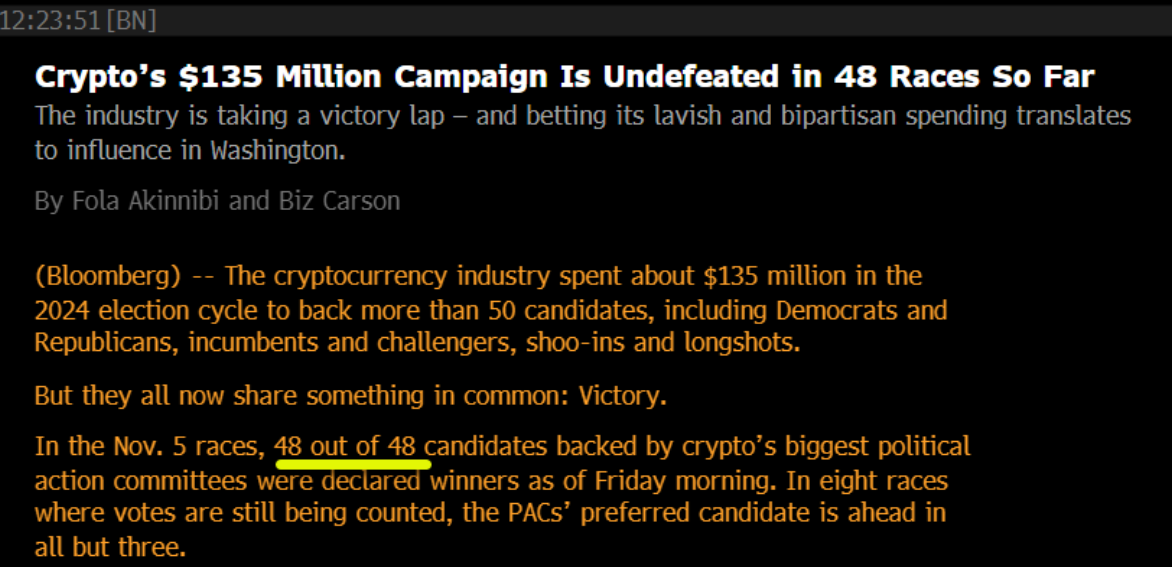

Large crypto companies like Coinbase, a16z and raised around $170 million this cycle and disbursed approximately $135 million via Fairshake. The message is strong and clear – that crypto is here to stay and will be a strong force in D.C. for years to come. StandWithCrypto, which currently has 1.9m advocates, has taken a stretch goal to get to 4m advocates by the 2026 midterms and will also be expanding their efforts to the G20 countries internationally. To put into context the success of these efforts, 48 out of 48 candidates backed by the fairshake PAC were declared winners as of Friday morning.

We have previously written about how Trump is looking to fire SEC Chairman Gary Gensler on day 1, create a strategic Bitcoin reserve and in general end anti-crypto policies.

The two most important events to follow over the next months is the appointment of a new SEC Chairman and the possible creation of a strategic Bitcoin reserve.

One rumored candidate for the job as SEC Chairman is SEC Commissioner Hester Peirce. She is in the industry known as “Crypto Mom” for her pro crypto stance. She has been an outspoken critic of Gensler’s aggressive and overreaching approach to crypto. It would be a major win for crypto if the Trump administration picks Peirce for the job.

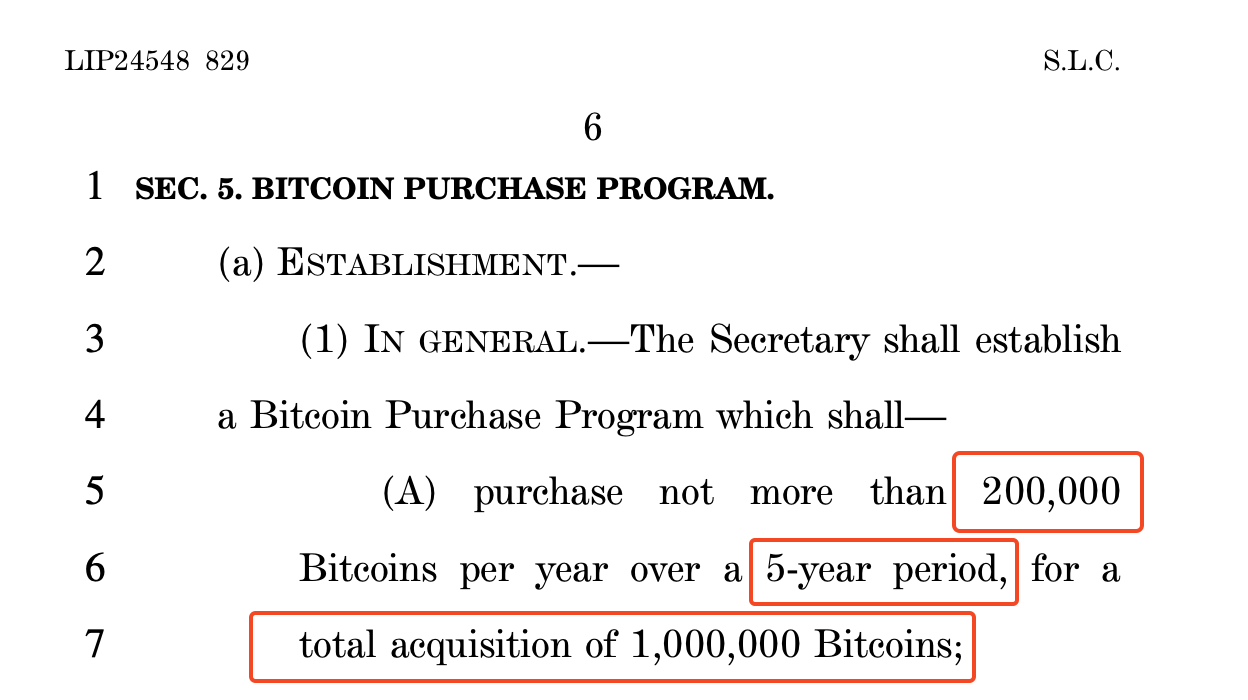

The other key development to watch will be if Trump keeps his promise of creating a strategic Bitcoin reserve. The “Bitcoin Reserve Act” aims to purchase 200,000 per year over a 5 year period. For reference, only 165,000 Bitcoin is mined per year.

And the intent is to hold it in perpetuity.

The US government is one of the largest holders of Bitcoin since they confiscated Bitcoin from the Silk Road marketplace in 2013. Trump has suggested this Bitcoin shouldn’t be sold or auctioned off but instead provide a base for a Bitcoin reserve. Senator Cynthia Lummis has been outspoken in her support of this idea. After the election win she posted this on X:

This wasn’t all, Eric Trump (Donald Trump’s son) who is expected to have an influence at the White House reposted an image from Michael Saylor (the CEO of Microstrategy) with a flag of Bitcoin hoisted on the White House.

Both these posts came in under 24 hours after a Trump win indicating that it is in the front of the administration’s mind and not just any other minor election issue which will be forgotten.

If the US government ends up holding Bitcoin as a strategic asset, it will send a signal to the rest of the world. G20 countries will likely follow and as the price goes up and Bitcoin is seen as an alternative to central banks holding gold reserves it could create positive reflexivity and a true repricing relative to gold.

It is noteworthy that Trump is now surrounded by Bitcoin and crypto enthusiasts. Future Vice President JD Vance has around $500,000 worth of Bitcoin in his investment portfolio. Cantor Fitzgerald’s CEO Howard Lutnick co-chairs Trump’s presidential transition team and is an outspoken advocate for Bitcoin. He personally holds hundreds of millions of dollars in Bitcoin. Elon Musk’s Tesla holds Bitcoin on its balance sheet and he himself has been an enthusiast for Dogecoin. Trump himself is an advisor for a DeFi project that has been launched by his children and which is built on top of one of our portfolio holdings, AAVE.

DeFi Renaissance

The emerging DeFi Renaissance we wrote about last month is now underway. We have seen big gains recently in DeFi stalwarts like AAVE, Uniswap, MakerDAO and Lido – all names in our portfolio. One reason for this is that DeFi is the one sector that has been held back the most by overreaching regulation by the current SEC. With less overbearing regulation and uncertainty we are likely to see DeFi protocols more willing to return revenue to token holders, creating value for investors. For the first time in many years, crypto can innovate freely and distribute revenues without the fear of the SEC breathing down its back.

Crypto has entered a Golden Age.

This blog post was co-authored with Apollo Crypto Head of Research & Portfolio Manager, Pratik Kala.

This report (‘Report’) has been prepared for informational purposes only and does not constitute an offer to sell or a solicitation of an offer to purchase any security of financial product or service. This Report does not constitute a part of any Offer Document issued by Apollo Crypto Management Pty Ltd (ACN 623 059 227, AFSL 525760) or Non Correlated Capital (ACN 143 882 562, AFSL 499882), the Trustee of the Apollo Crypto Fund. Past performance is not necessarily indicative of future results and no person guarantees the performance of any Apollo Crypto financial product or service or the amount or timing of any return from it. This material has been provided for general information purposes and must not be construed as investment advice. Neither this Report nor any Offer Document issued by Apollo Crypto or Non Correlated Capital takes into account your investment objectives, financial situation and particular needs. The information contained in this Report may not be reproduced, used or disclosed, in whole or in part, without prior written consent of Apollo Crypto. This Report has been prepared by Apollo Crypto. Apollo Crypto nor any of its related parties, employees or directors, provides and warrants accuracy or reliability in relation to such information or accepts any liability to any person who relies on it. You should obtain a copy of the Information Memorandum, issued by Non Correlated Capital before making a decision about whether to invest in the Apollo Crypto Fund.