categories

All Categories

- Bitcoin

- Centralised Exchanges

- Crypto

- Crypto Asset Volatility

- Crypto Correlations

- Crypto Governance

- Crypto in the Portfolio

- Crypto Valuations

- DeFi

- ESG

- Ethereum

- Investment Highlight

- Regulation

- Security and Privacy

- Social Media Influence

- Stable Coins

- Traditional Finance and Crypto

- Uncategorized

- UNSDG

- Web 3.0

Authors

All Authors

Bitcoin Halving Analysis

by Quinn Papworth

What is a Bitcoin Halving?

The Bitcoin halving is a supply event that occurs every 210,000 blocks or every four years. This event reduces the reward for mining new Bitcoin blocks by half, instantly impacting the supply entering the market everyday via block rewards. The halving event aims to maintain the scarcity of Bitcoin by gradually decreasing the rate at which new Bitcoin is introduced into circulation.

In Bitcoin’s history it has undergone three halving events – in 2012, 2016, and 2020. BTC rewards per block have transitioned from the initial reward of 50 BTC per block all the way down to 6.25 BTC per block. The next halving event is now just under 60 days away where the BTC reward per block will be halved again falling to just 3.125 BTC. As such we thought it was timely to write about its expected impact alongside other positive tailwinds for the crypto industry.

How Bitcoin Blocks Are Issued & Rewarded

The BTC reward per block, or subsidy, is distributed to miners as a way to reward and incentivize the computational power that is being provided to secure the Bitcoin network through the Proof of Work (PoW) consensus mechanism. In other words, the BTC block subsidy can be described as Bitcoin’s security budget that is paid to miners for their computational work being used to secure the network. This financial incentive ensures the consistent health of the network through three pillars; validation of transactions, creation of new blocks, and decentralisation and security.

Quantifying Block Rewards

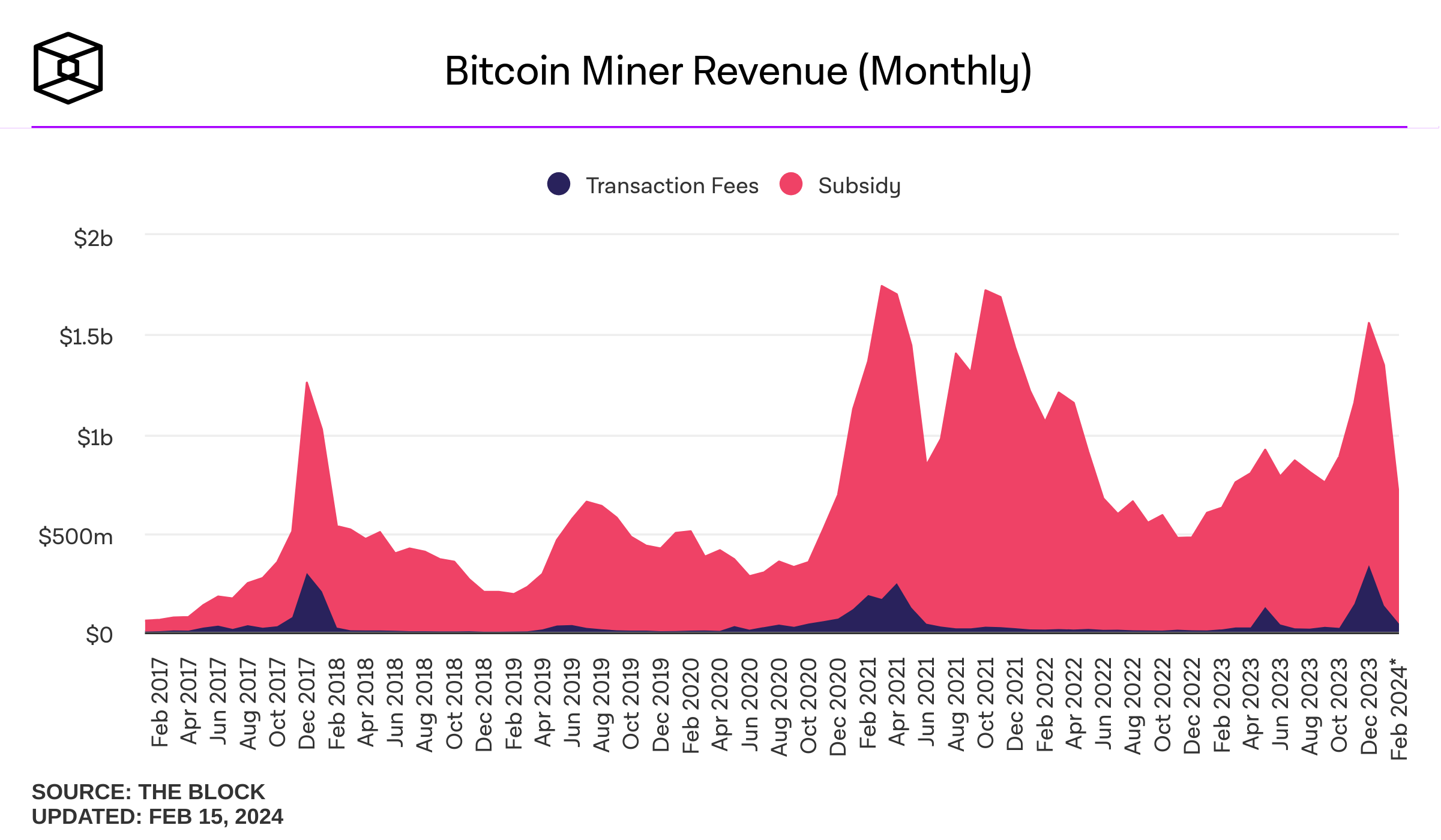

Bitcoin’s security budget in 2023 was estimated at roughly US$ 9.7 Billion according to the market price of Bitcoin as it was mined. The total miner revenue for the year takes into account block subsidy as well as transaction fees paid to miners. Notably 2023 saw a large increase in the revenue earned from transaction fees as a result of Bitcoin Ordinals.

Why Are Halvings Significant?

Bitcoin halvings are significant as they continually make Bitcoin a scarcer asset and solidify its store of value quality by reducing its issuance. As a result we have historically seen significant price moves leading up to and after each Bitcoin halving. This is usually due to a ‘supply shock’ where Bitcoin available on exchanges dwindles significantly as a result of the supply halving.

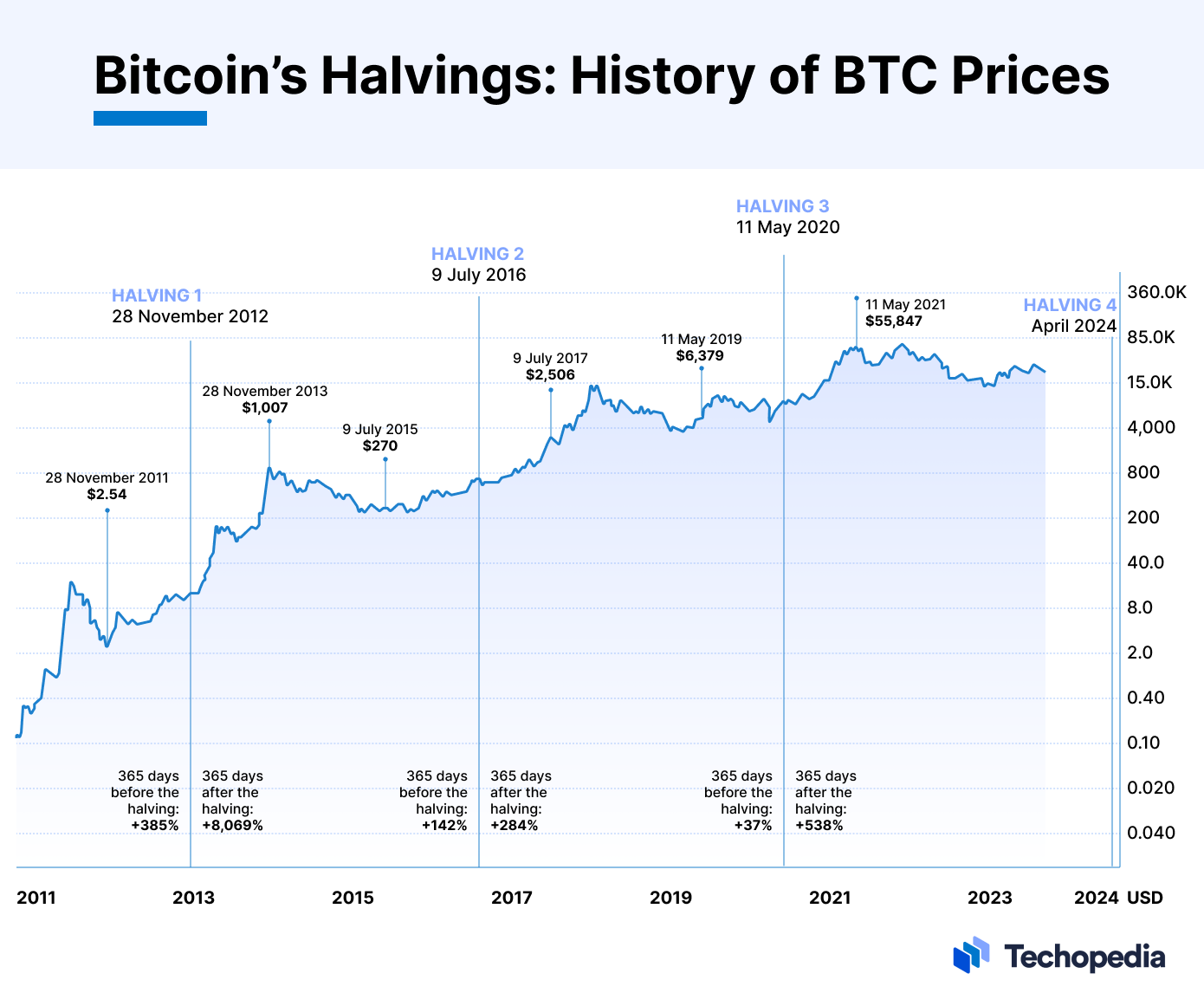

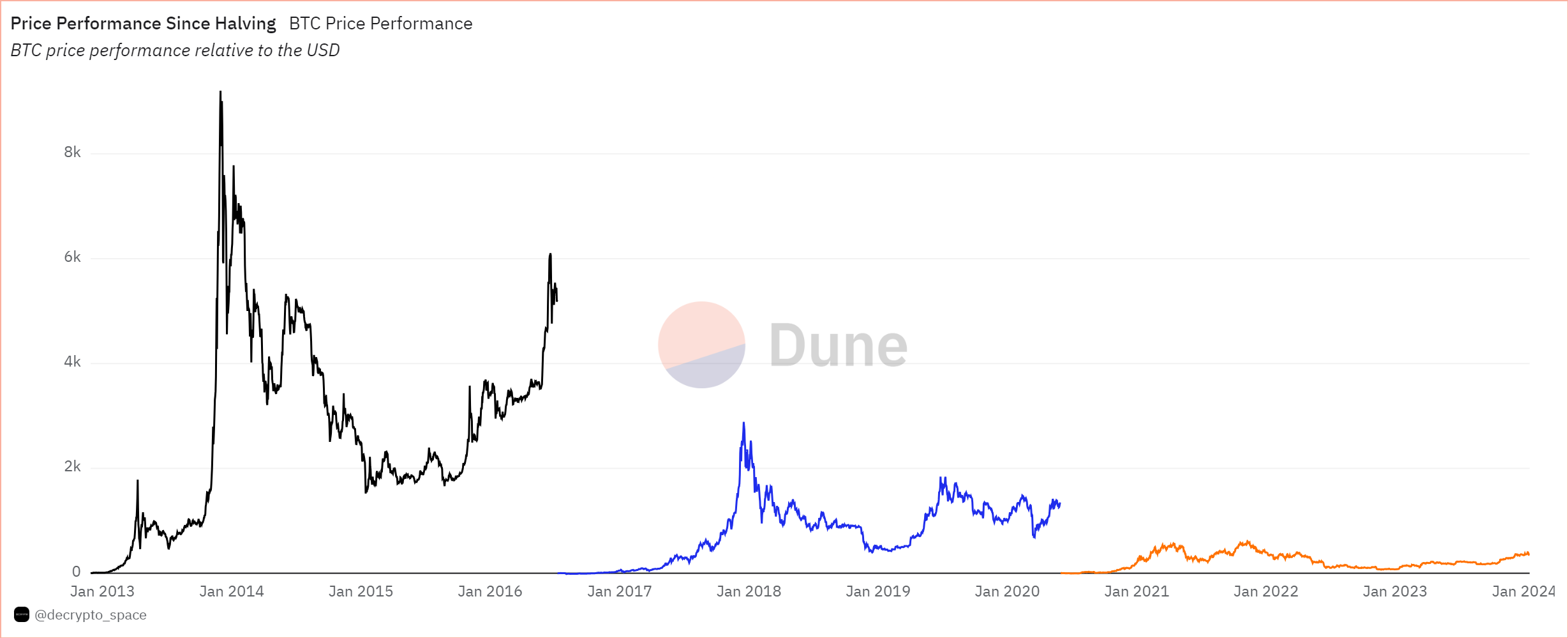

The 4 Year Cycle

As a result of the halving events Bitcoin has historically followed a cyclical pattern where the 365 days pre-halving and post-halving boast significant returns while the two years in between tend to have significant drawdowns. Bitcoin is on track to repeat history this year with a performance of 120.5% in the last year as we near the halving date.

However it should be noted that it is largely unrealistic to expect returns in the same magnitude as some of the prior cycles. This is due to the fact that as Bitcoin matures as an asset class it is expected to have diminishing returns. This is supported by the nature of Bitcoin itself where its halvings arguably become less and less meaningful over time due to the smaller difference in halvings as measured in BTC terms. This has historically been supported by the price action of Bitcoin where four cycles (as measured from halving to peak) in a row diminishing returns have played out.

What’s Different About This Halving?

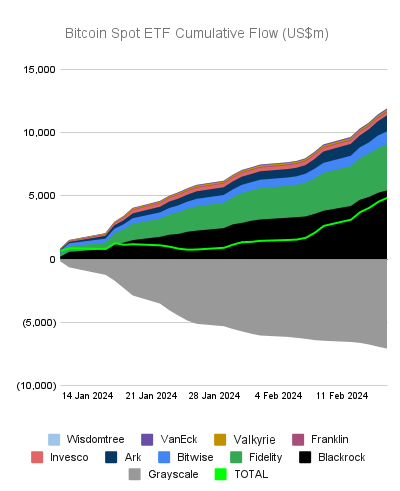

We are watching this halving event closely due to the increased demand for Bitcoin from institutional buyers through the new spot Bitcoin ETFs. When you consider the effect of the spot Bitcoin ETFs and the Bitcoin halving in isolation they already prove to be significant catalysts for the growth of Bitcoin. However, when you consider them in tandem, you get an outcome that has potential to be extraordinary.

With the introduction of spot Bitcoin ETFs earlier this year there are now significant daily purchases of BTC, so far there is an average net inflow of US$ 182 million daily. This demand dwarfs the total daily Bitcoin rewarded to miners post halving of roughly US$ 22.5 million at current prices.

When you combine this with the fact that BTC reserves on exchanges are at multi-year lows of roughly 2 million BTC, there will not be enough Bitcoin for buyers if current prices remain. At the current BTC price of roughly US$ 50,000 the exchange reserves would be depleted in just 550 days or 627 days if miners are selling all of their BTC rewards daily post halving. As a result of this the price will have to move upwards if these levels of demand remain as the asset will become vastly more scarce in a rapid manner.

Simply put, if the current demand levels remain as the supply of BTC decreases, it is likely that there is nowhere for the price of BTC to move except upwards over the fullness of time. Furthermore a 2022 study showed Bitcoin demand can have a positive price elasticity during up-markets, as a result its demand can theoretically increase with its price in a bull market leading to high potential upside, we have seen such phenomena occur in 2021 where retail investor FOMO drove up the price of Bitcoin significantly. We have yet to see an increase in social metrics in the recent recovery indicating there is still room for a retail rally in addition to the current institutional interest in Bitcoin.