categories

All Categories

- Bitcoin

- Centralised Exchanges

- Crypto

- Crypto Asset Volatility

- Crypto Correlations

- Crypto Governance

- Crypto in the Portfolio

- Crypto Valuations

- DeFi

- ESG

- Ethereum

- Investment Highlight

- Regulation

- Security and Privacy

- Social Media Influence

- Stable Coins

- Traditional Finance and Crypto

- Uncategorized

- UNSDG

- Web 3.0

Authors

All Authors

Crypto Correlations – Update April 2023

by Tim Johnston

Crypto assets have had a unique path. They are the first asset class that has started with retail participants, slowly working their way up to institutional investors. In the past, a new asset class usually started with the privileged elite and slowly made its way down to retail investors. This unique path creates an independence of crypto assets – they are independent, by their nature, from traditional assets like equities and bonds. We have long suggested that this independence should, in theory, lead to a lower correlation in returns.

The first of February 2023 marked the 5 year anniversary of Apollo Crypto. In addition to a quiet celebration of this milestone, it means we now have 5 years worth of performance data for the Apollo Crypto Fund. We analyse this data below and take at the correlations of crypto assets to traditional assets.

Let’s establish some basics to start. If two assets are perfectly correlated, that is, their price action moves perfectly in sync, we can expect a correlation number of 1. If two assets are inversely correlated, that is, their price action moves in the exact opposite direction, we can expect a number of -1. If two assets are not correlated at all, we can expect a number of 0. In calculating the correlations between crypto assets and traditional assets, we have used the Apollo Crypto Fund’s monthly returns since inception on 1 February 2018. For traditional assets, we have used various Vanguard Exchange Traded Funds (ETFs) listed on the Australian Stock Exchange. All performance data is calculated in Australian dollars. To our global audience, we expect the key themes of this data will hold in different currencies.

Previous Observations

Over the journey, we have written about correlations of crypto assets to traditional assets.

In March 2022, we outlined two key takeaways:

Takeaway #1: Crypto Assets Are Not A Short-term Hedge

To describe crypto assets as a hedge against equity markets is unrealistic. Equally, we don’t think it is appropriate to describe a young technology as a safe haven asset class. It is unrealistic to view crypto assets as a safe haven asset class as well as a technological innovation with enormous upside potential.

We have seen a number of times now that crypto assets are not a short-term hedge. Crypto asset correlations increased significantly in March 2020 when the effects of Covid-19 hit markets. Correlations also were high throughout 2022 when markets were largely driven by macro events and increasing interest rates.

Takeaway #2: Crypto Assets Are Still Largely Uncorrelated To Traditional Assets

We can see…that crypto assets, over a long period of time, are still largely uncorrelated to traditional assets. If anything, it appears crypto assets have become less correlated over the last two years.

We think both these takeaways from the March 2022 Update still hold.

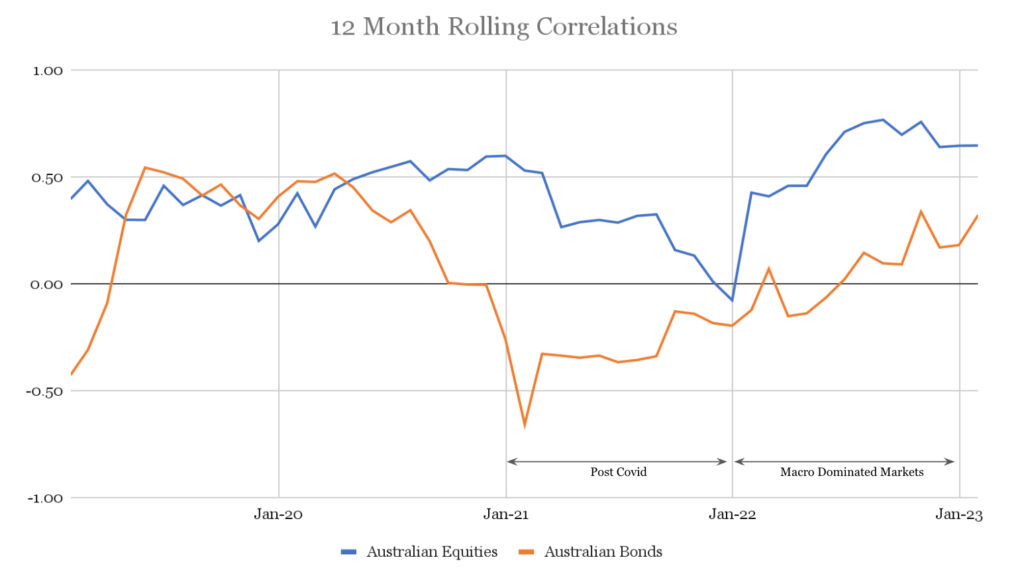

Referencing the blue line in the graph below, correlations between crypto markets and Australian equities did in fact drop between January 2021, when the novelty of Covid-19 had worn off, and January 2022, which began the year of marco dominated markets. The effect of this was an increase in correlation between crypto markets and equity markets.

Source: Apollo Crypto, monthly performance data

Long-Term View

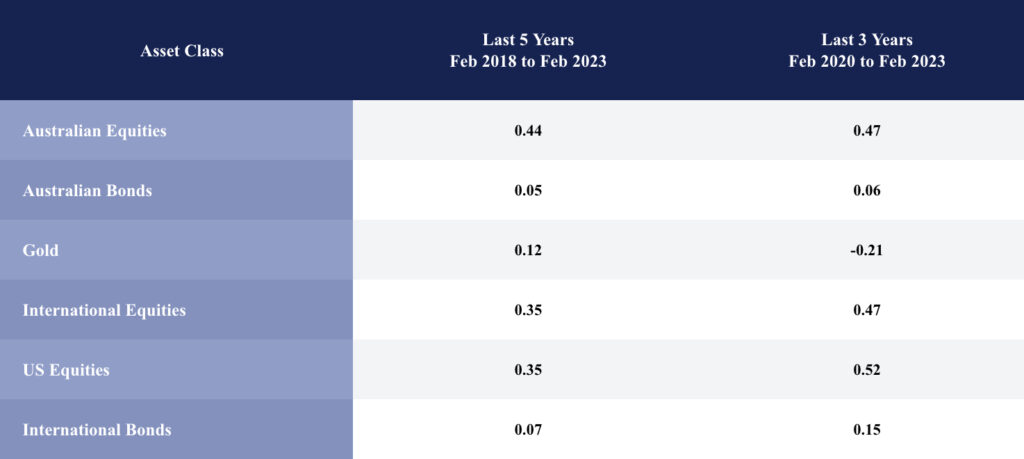

We think it’s helpful to zoom out and take a long-term view. Crypto asset correlations to Australian Equities have increased slightly over the last three years. Correlations to US Equities and International Equities have increased substantially.

Source: Apollo Crypto, Monthly performance data

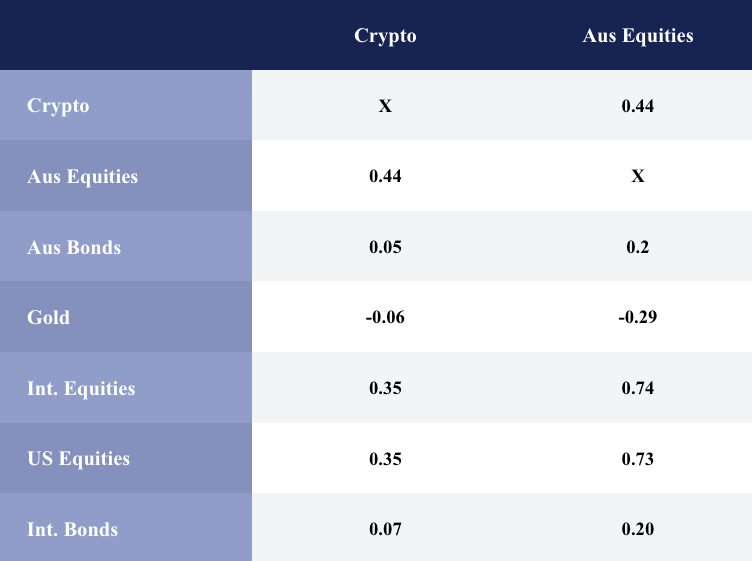

Australian Equities has a correlation of 0.74 and 0.73 to International Equities and US Equities, respectively. We compare that correlation, over the same time period, to Crypto of 0.44. The correlation is substantially lower than for International and US Equities.

Source: Apollo Crypto, monthly performance data, 1 Feb 2018 to 31 January 2023

In times of relative market stability, crypto assets will be given the freedom to act independently, as is suggested in theory. We expect correlations will decrease. There is possibly evidence of this in the performance of Bitcoin compared to Australian Equities in the first few months of this year. Bitcoin has performed strongly amid banking concerns in the US. Indeed, we have analysed the short-term data and over Q1, Bitcoin’s daily correlation to Australian Equities is a low 0.08. That is, there is almost no correlation.

We posit that the dominating factor is investor sentiment. In March 2020, investors were fearful and largely sold all assets, whether they be crypto or traditional assets. Correlations then increased again in 2022 as fear returned due to macro factors. Again, when investors are fearful and keen to sell, crypto markets are not spared.

We have always encouraged a long-term investing mindset at Apollo. We can see that investors that hold through the cycle enjoy the diversification benefits of crypto assets. Crypto assets have a low correlation to traditional assets with a long term view, as long as investors take a long term view and are prepared for short term volatility and spikes in correlation.