categories

All Categories

- Bitcoin

- Centralised Exchanges

- Crypto

- Crypto Asset Volatility

- Crypto Correlations

- Crypto Governance

- Crypto in the Portfolio

- Crypto Valuations

- DeFi

- ESG

- Ethereum

- Investment Highlight

- Regulation

- Security and Privacy

- Social Media Influence

- Stable Coins

- Traditional Finance and Crypto

- Uncategorized

- UNSDG

- Web 3.0

Authors

All Authors

Ethereum Staking and Restaking

by David Angliss

Introduction

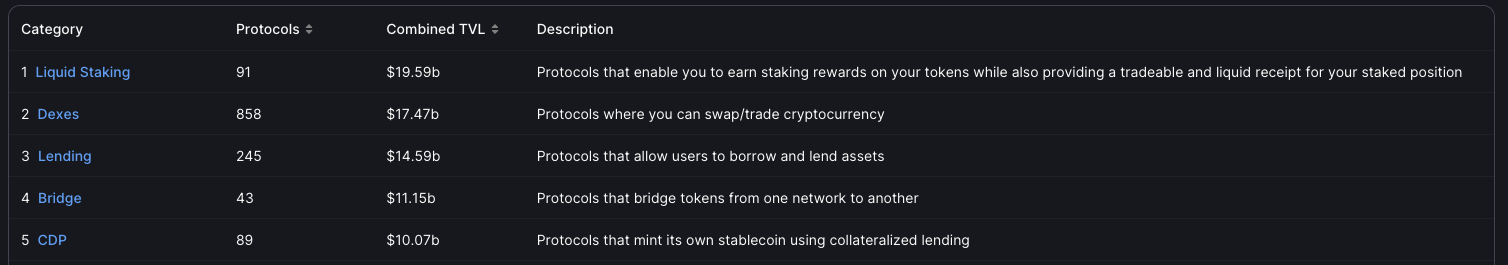

In the world of Decentralised Finance (DeFi), Decentralised Exchanges (DEXs) and lending platforms have traditionally been the frontrunners, attracting significant Total Value Locked (TVL) metrics. Uniswap, Curve, and now Maverick have pioneered the path for Decentralised Exchanges, amassing a TVL of $17.47 billion. Aave and MakerDAO, on the other hand, have laid the groundwork for decentralised lending, commanding a TVL of $14.59 billion. Consequently, these five influential projects form the core holdings of our DeFi investment strategy.

However, we are currently witnessing a transformative moment in DeFi. Liquid staking protocols have emerged as new players, surpassing lending and exchanges in TVL, with an impressive $19.59 billion. We have previously delved into the subject of liquid staking protocols in our Swell Research Report and Swell Network update, recognising their potential influence on the future of Ethereum. Therefore, we have decided to increase our allocation to this segment of the market in our Frontier Fund.

In this article, we will explore the significant progress made in the realm of liquid staking and introduce a novel concept derived from its innovative wave — ‘restaking.’ Furthermore, we are thrilled to announce our participation in the EigenLlayer series A fundraising as the project marks an exciting step forward in this field.

Top 5 categories within DeFi by TVL

https://defillama.com/categories

Liquid Staking Protocols

Liquid Staking platforms provide a convenient and straightforward way for users to participate in staking directly through Proof of Stake (PoS) smart contract platforms. These platforms eliminate the need for users to possess certain capital and technical requirements that are typically demanded by PoS smart contract platforms as the Liquid Staking platforms take care of those requirements. While liquid staking protocols have been present on other blockchains before Ethereum’s transition to Proof of Stake, we have witnessed a significant surge in the TVL of Liquid Staking protocols across the industry since Ethereum made the switch.

Compared to other segments of DeFi, liquid staking is relatively new and currently comprises only 91 protocols, whereas Dexes and Lending encompass 858 and 245 protocols, respectively. However, as Ethereum continues to grow, we anticipate a notable expansion in the number of liquid staking offerings. This growth is a testament to the increasing recognition and adoption of liquid staking as an integral part of the DeFi ecosystem.

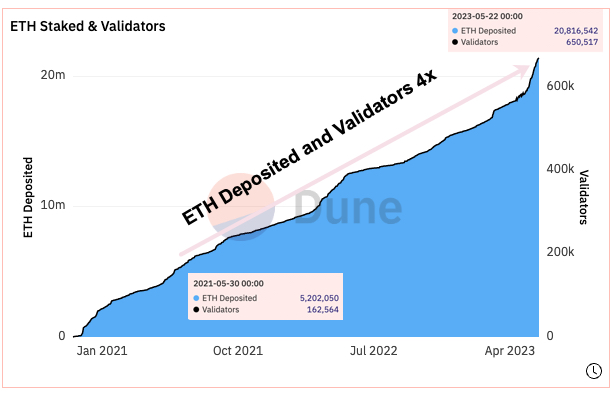

In the past two years alone, the amount of Ethereum staked, and the number of validators employed has multiplied by four, indicating a significant increase in participation and confidence in the staking process. This demonstrates the growing interest and commitment from the Ethereum community in securing and validating the network through staking.

Growth of ETH Staked and Number of Validators

https://dune.com/hildobby/eth2-staking

Today, roughly 18% of the total ETH supply is staked and/or in the activation queue. Even now, this remains well below the average of ~60% for the largest PoS blockchains, suggesting that far more ETH will be making its way to validators in the future.

Within the Ethereum network, there are two avenues for staking ETH. The first entails establishing a validator, a process demanding 32 Ethereum and the technical acumen to ensure the validator operates honestly and avoids penalties. The alternative, and more widely embraced approach, involves leveraging Liquid Staking protocols. This method is less capital-intensive and demands fewer technical prerequisites. By harnessing liquid staking protocols, users can effortlessly stake any desired amount of Ethereum on these platforms, promptly commencing the accrual of staking rewards without the intricacies associated with setting up a personal validator.

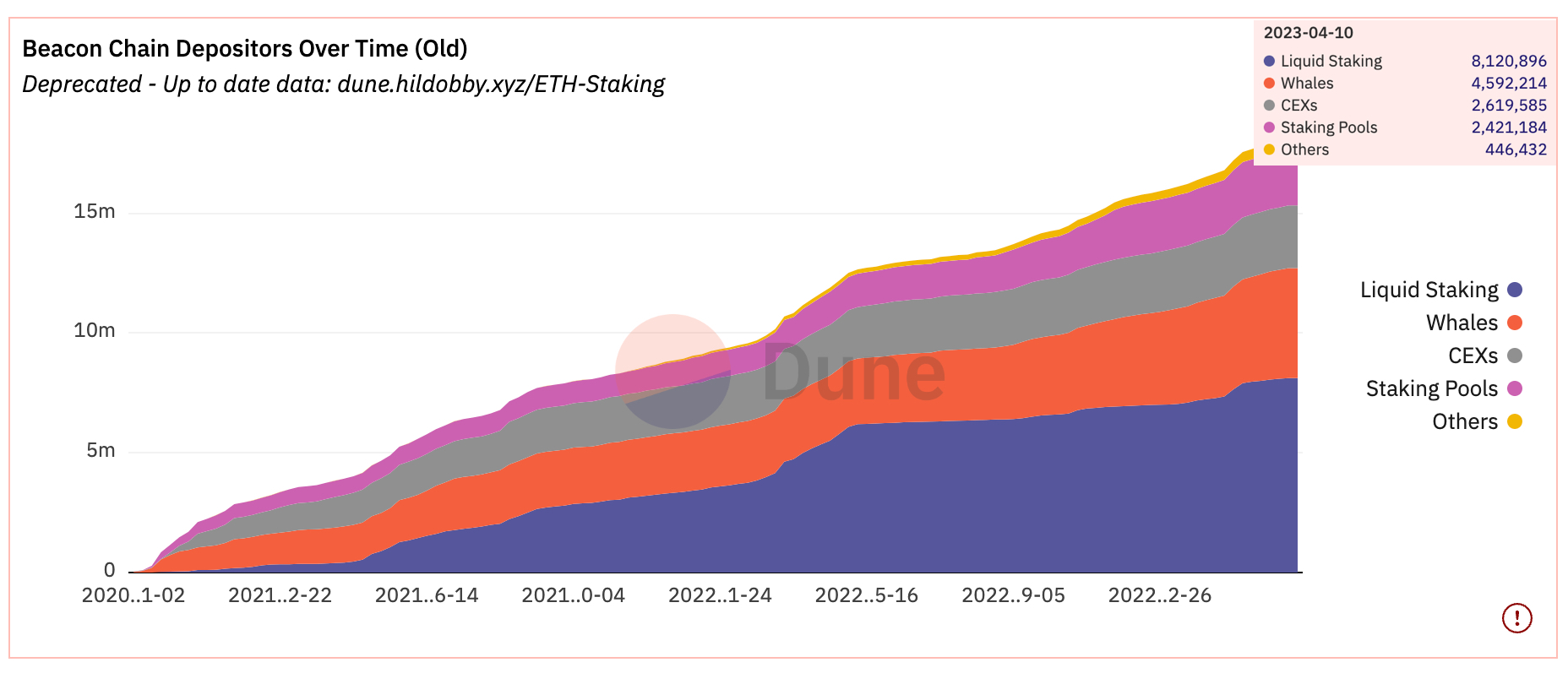

Type of Stakers on Ethereum

https://dune.com/hildobby/eth2-staking

The latter notion has garnered remarkable popularity within the DeFi market, leading to the swift accumulation of substantial TVL in the form of staked ETH. Projects like Lido, Coinbase, Rocket Pool, and Frax have swiftly emerged as prominent players, drawing in significant amounts of staked ETH within a remarkably brief timeframe.

Top four Liquid Staking Protocols

https://defillama.com/protocols/Liquid%20Staking

The unrivalled leader in the Liquid Staking arena is none other than Lido Finance. With the advantage of being the first mover in this domain, Lido swiftly established itself as the go-to provider for liquid staking services across multiple PoS chains. Its ascent commenced shortly after the launch of Ethereum’s beacon chain in early 2021. Since then, Lido has solidified its position, towering over its competitors with a staggering five-fold larger presence. The trajectory of Lido’s growth remains robust, further cementing its reputation as an industry frontrunner. In light of these compelling factors, we have increased our exposure to Liquid Staking through the acquisition of Lido tokens.

Another notable protocol granting us exposure to this burgeoning segment within DeFi is Swell Network. We recently shared insights on Swell Network in our comprehensive update at the beginning of this month, shedding light on its unique offerings and contributions to the ecosystem.

Introduction to ‘Restaking’

Let’s take a moment to recap the concept of ‘staking’. When users stake Ethereum on Liquid Staking platforms, they receive derivative staking tokens in return, representing the ETH that has been staked. These derivative tokens possess inherent value, typically equivalent to the face value of the staked ETH, as they contribute to maintaining the security and consensus of the blockchain.

Until recently, these derivative tokens have found utility within DeFi. They have been paired with other crypto assets in Automated Market Makers (AMMs), utilised as lent-out assets in lending protocols, and even employed as collateral to obtain loans.

However, it was only a matter of time before a group of visionary individuals began pondering an intriguing question: Could these derivative tokens be “restaked” to further fortify network security and potentially yield additional rewards?

EigenLayer

EigenLayer is a new tool that makes staking even better. It allows users to take the Ethereum they already staked and use it to secure not just the Ethereum blockchain, but many different decentralised applications at the same time. EigenLayer enhances the staking experience, revolutionising the way users secure their assets. With EigenLayer, individuals can leverage their staked Ethereum not only to reinforce the security of the Ethereum blockchain but also to safeguard numerous decentralised applications simultaneously. This remarkable advancement empowers users to expand the safety net of various applications on Ethereum, encompassing oracles, bridges facilitating cross-chain asset transfers, and even standalone layer 2 solutions.

The true potential of EigenLayer lies in its ability to aggregate and extend crypto economic security through restaking while validating the novel applications being developed atop Ethereum. This immense potential has generated tremendous excitement within the DeFi market, attracting substantial investments and guidance from renowned crypto investors. Notably, Apollo Crypto is among the investors participating in EigenLayer’s Series A funding round, valuing the project’s tokens at an impressive $500 million fully diluted market cap. Other notable contributors throughout the pre-seed to Series A stages include esteemed names like Blockchain Capital, Figment Capital, Ambush Capital, Coinbase Ventures, and Polychain, underscoring the widespread confidence in EigenLayer’s disruptive potential.

Immersed in the captivating world of DeFi, EigenLayer has taken a significant step forward with its fully operational testnet, leaving the market eagerly anticipating its imminent mainnet launch. The burning question emerges: Will EigenLayer emerge as the pioneering force among the “Restaking” protocols in the DeFi landscape? Could it potentially reach the heights of prominence and impact that Lido has achieved within Liquid Staking? Only time holds the answer, but the Ethereum DeFi community is currently beaming with excitement for the future use cases EigenLayer will bring to Ethereum.