categories

All Categories

- Bitcoin

- Centralised Exchanges

- Crypto

- Crypto Asset Volatility

- Crypto Correlations

- Crypto Governance

- Crypto in the Portfolio

- Crypto Valuations

- DeFi

- ESG

- Ethereum

- Investment Highlight

- Regulation

- Security and Privacy

- Social Media Influence

- Stable Coins

- Traditional Finance and Crypto

- Uncategorized

- UNSDG

- Web 3.0

Authors

All Authors

DeFi TVL Performance in Various Ecosystems

by David Angliss

Today’s article will build on our previous article, “DeFi Total Value Locked Boom“, from September 2021. We have witnessed considerable change in the global macroeconomic environment and crypto ecosystem during this time. These broader changes have harmed DeFi TVL. However, the fundamentals of what makes a strong DeFi ecosystem in the long term have not varied.

Fundamentals of Strong DeFi Ecosystems

A few key fundamentals contribute to an ecosystem’s strength and success in the DeFi sector. The first attribute of a vibrant DeFi ecosystem is a Decentralised Exchange (DEX) with high liquidity and high Total Value Locked (TVL). Traditionally successful DEXs will also have native tokens to incentivise liquidity. The largest DEXs in the market today are Uniswap and Curve. These protocols incentivise users to provide the automated market maker with liquidity for transaction fees and tokens – a current strategy we implement in our ACOF is allocating capital to the Curve mUSD pool to earn an annual yield of 7.84%. For an in-depth description and demo of how DEXs operate, please refer to our ‘DeFi Explained’ video covering the DEX SushiSwap.

The second ingredient to a thriving DeFi blockchain is to have strong, decentralised money markets (borrowing and lending protocols) that are trustworthy and reliable. Trust and reliability are commonly measured in the TVL the platforms can garner. Users feel more comfortable interacting and depositing capital into protocols that have become battle-hardened through time in the market and those that have undergone excessive code audits. Protocols that hit this profile are Aave and Compound. They are considered the most trusted protocols in this DeFi category and span multiple blockchains.

The last fundamental contributor to a flourishing DeFi ecosystem is the incentive programs and strategic marketing. Polygon, Binance Smart Chain, and Avalanche are all crypto assets held by Apollo Capital and have had their growth catalysed by large scale incentive programs targeting both developers and users. These incentive programs allocate the blockchain’s native token to protocols and yield farmers to promote TVL growth and development.

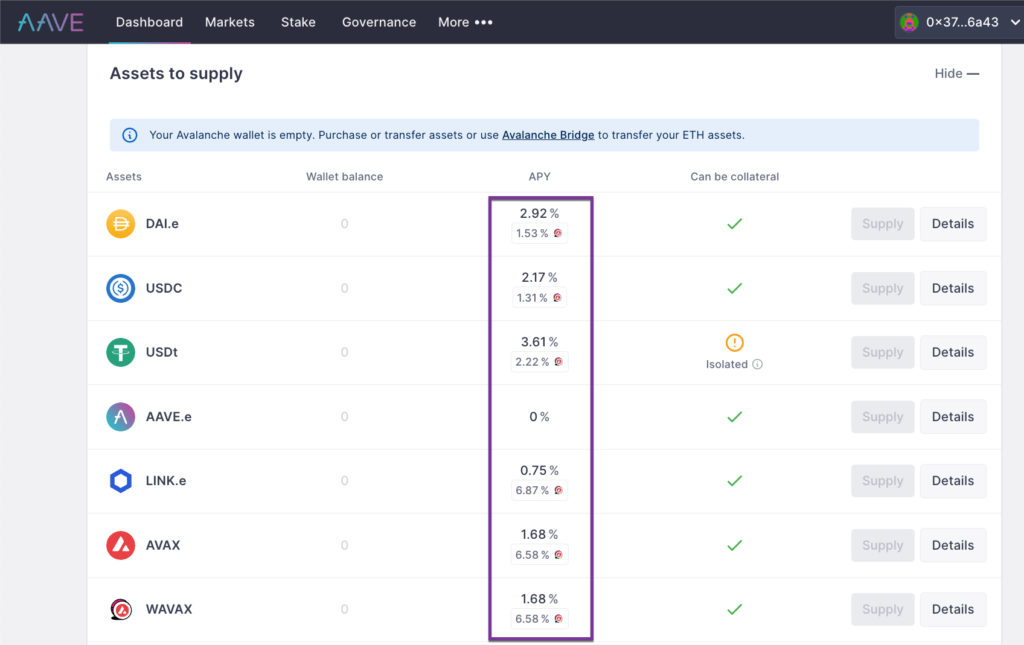

Here we can see Avalanche is running an incentive program on one of the largest and most trusted money market protocols, AAVE. In addition, the interest in the token a DeFi user can earn supplying it. The user can also earn wrapped AVAX as a reward for utilising the AAVE.

Without well-established decentralised exchanges and money market protocols, blockchains will naturally have a lower TVL than other ecosystems. Algorand is another asset held by Apollo Capital with a relatively low TVL compared to another layer one chain with its decentralised money market, AlgoFi and decentralised exchange Tinyman, both still in their infancy. However, smaller ecosystems in the top 100 crypto assets such as Alogrand have the potential to increase if their dApps gain traction and strategic liquidity incentives are initiated. Ecosystems such as Solana, Avalanche and Polygon covered in this article make fantastic examples of TVL growth.

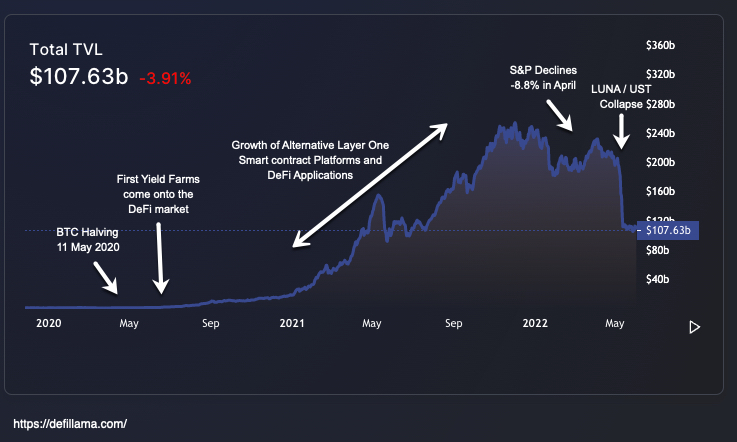

Current TVL in Crypto 2022

The TVL in decentralised finance (DeFi) is currently at its lowest point in 2022. TVL has dropped from over $240B in January to around $107.6B today (-55%). This decline is due to crypto and macroeconomic factors. Luna’s failure has brought the public’s attention to DeFi. The world witnessed a $30B TVL loss in Luna’s ecosystem and represented a large proportion of TVL in DeFi. This recent event has shaken the whole DeFi sector, so we have seen recent reductions in TVL of most layer one ecosystems. Decreasing token price locked up contributes to a decrease in TVL, and the crypto market’s current correlation to the broader equities markets has also been another contributor. By the end of April 2022, the S&P 500 recorded a loss of 13.8%, its worst start to the year since World War II. This negative sentiment generated from the federal reserve rate hikes and global supply constraints flowed into DeFi asset valuations.

This graph illustrates the adoption of DeFi before the onset of adverse macroeconomic factors at the beginning of 2022 and the collapse of Luna (Terra) in early May 2022.

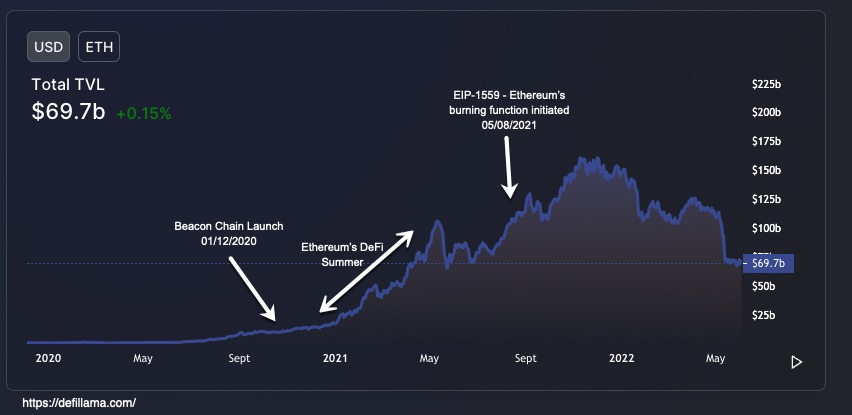

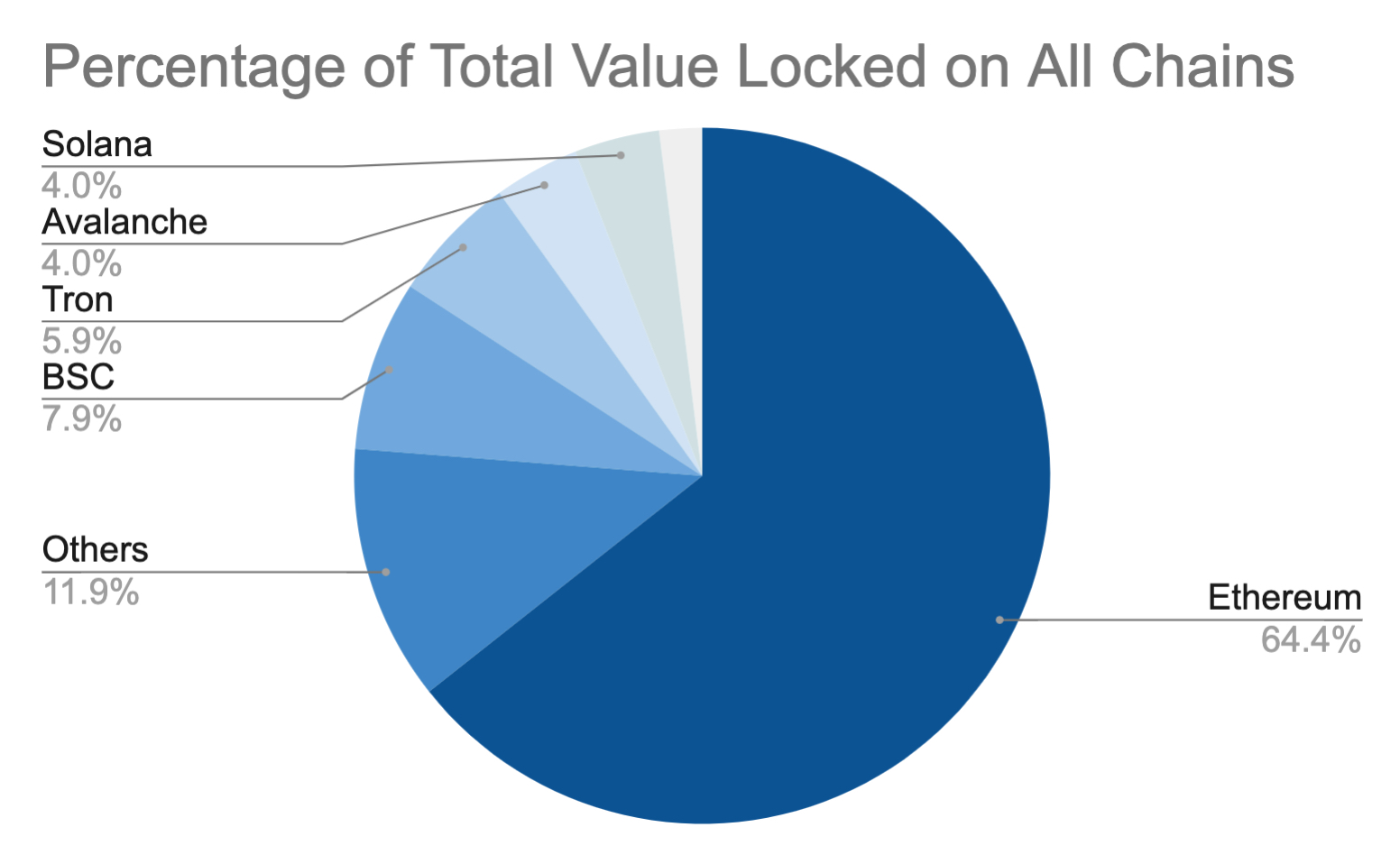

Total Value Locked in Ethereum

Ethereum is the market leader in DeFi ecosystems. It has the largest TVL as well as the most developer activity. As it is the original, most decentralised and secure smart contract platform, it has the most trust amongst DeFi users. With a TVL of $69.7B, its dominance stands at almost 65% of the total TVL in DeFi. MakerDao (MKR), built on the Ethereum network, is the largest DeFi project with a current TVL of $9.5B (8.75% dominance in the DeFi sector ) from a high of $18B at the beginning of 2022. MakerDao is Ethereum’s largest money market, allowing for lending and borrowing of digital assets. MakerDao is also the protocol behind the most decentralised over-collateralised stablecoin DAI. Ethereum also supports the leading decentralised exchange (DEX) in DeFi, Uniswap, which currently has a TVL of $5.55B and has recently surpassed $1 trillion in transaction volume. Ethereum is the well-established market leader in DeFi it is not as reliant on incentive programs to entice more TVL.

Key Statistics

- Represents 65% of TVL in Defi.

- The network supports the largest DeFi project and money market (MakerDao) and the largest DEX (Uniswap).

- Currently, $69.7B TVL in Ethereum, reaching an annual high of $150B at the start of January 2022.

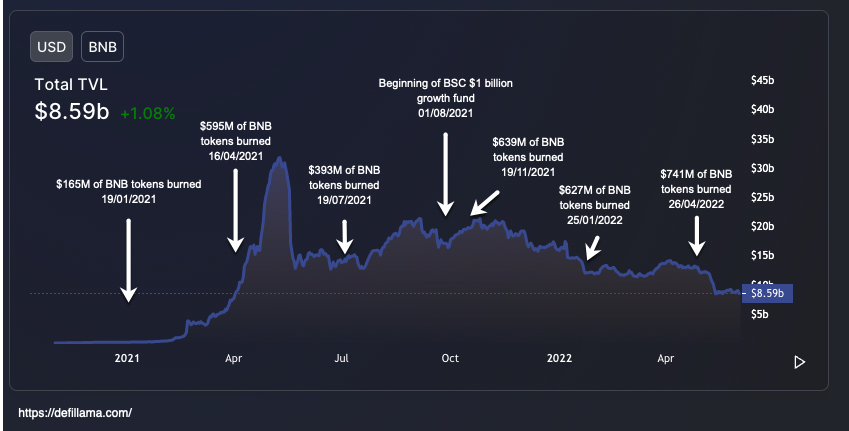

Total Value Locked in Binance Smart Chain

Binance Smart Chain (BSC) is a layer one blockchain built for easy and secure smart contract applications. Running alongside Binance Chain, BSC is Ethereum Virtual Machine (EVM) compatible, meaning that the codes developers use can function and execute smart contracts as they would on Ethereum – this enables developers to develop and use various decentralised applications.

The Binance Smart Chain is currently the second-largest ecosystem for TVL in its DeFi sector – with a current TVL of $8.6B, making up 8.0% of the total TVL in DeFi. Binance Smart Chain’s leading protocol is PancakeSwap, a widely trusted DEX that accounts for over 46% of the network’s TVL. PancakeSwap is currently the second-largest DEX in the entire DeFi space and is a significant reason BSC has had a successful start in decentralised finance. Venus Protocol is BSC’s largest and most trusted money market that enables lending, borrowing, and credit on digital assets – TVL of $817.5M.

Binance also dedicated $1B to growth the Binance Smart Chain in October 2021, with $100M allocated to developing and supporting DeFi protocols. Another clever method Binance utilises to help increase the price of their native token BNB and, in turn, increase TVL is to decrease the supply of BNB every quarter via a token burn. The token burn will stop once the total supply reaches 100,000,000 BNB (currently 163,276,974).

Key Statistics

- Accounts for 8.0% of TVL in DeFi.

- PancakeSwap is the second-largest DEX in crypto after Uniswap.

- Venus Protocol (XVS) is BSC’s largest money market.

- Currently, $8.6B TVL in Solana, reaching an annual high of $17.4B at the beginning of January 2022.

- Significant amounts of BNB are removed (burnt) each quarter.

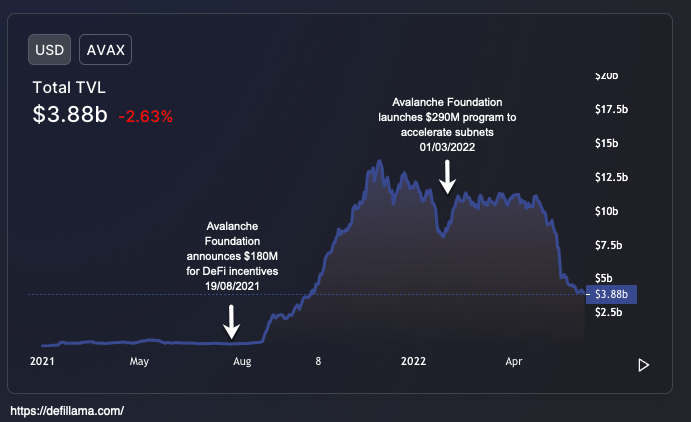

Total Value Locked in Avalanche

Avalanche is a top tier Proof-of-Stake (PoS) smart contract protocol and is currently ranked #4 for largest TVL. Avalanche’s native token AVAX has been a top performer in the flagship Apollo Capital Fund. It now has a TVL of $4.2B and TVL dominance of 3.8% in the DeFi sector. Avalanche allows users or projects who stake their AVAX token to create their own layer one or layer two blockchains validated by subnets (set of validators). This feature allows Avalanche to be compatible with Ethereum, allowing developers to easily port their Ethereum dApps to an independent Avalanche subnet to gain control over its security and function.

Ethereum DeFi protocols currently supported by Avalanche include the lending protocol AAVE, Curve and Sushiswap. TraderJoe is the second-largest protocol on Avalanche in terms of TVL ($400M TVL), which is an exclusive DEX to the blockchain. The most extensive protocol on Avalanche in terms of TVL is AAVE V3, the ecosystem leading money market used to earn interest in supplying and borrowing digital assets. AAVE is a highly renowned DeFi money market available on layer ones such as Ethereum, Avalanche, Polygon, Fantom, Artbitrum, Harmony and layer twos such as Arbitrum and Optimism.

The Avalanche Foundation DeFi incentive announcement was one of the first major DeFi incentive programs the industry experienced. We can see the TVL that flowed in, confirming it as one of the most successful incentive programs in 2021.

Key Statistics

- Accounts for 3.6% of TVL in DeFi.

- Compatible with Ethereum dApps through unique subnet integration.

- Currently, $3.9B TVL in Avalanche, reaching an annual high of $11.7B at the start of January 2022.

- Large fund allocations from Avalanche Foundation for DeFi incentives and subnet growth.

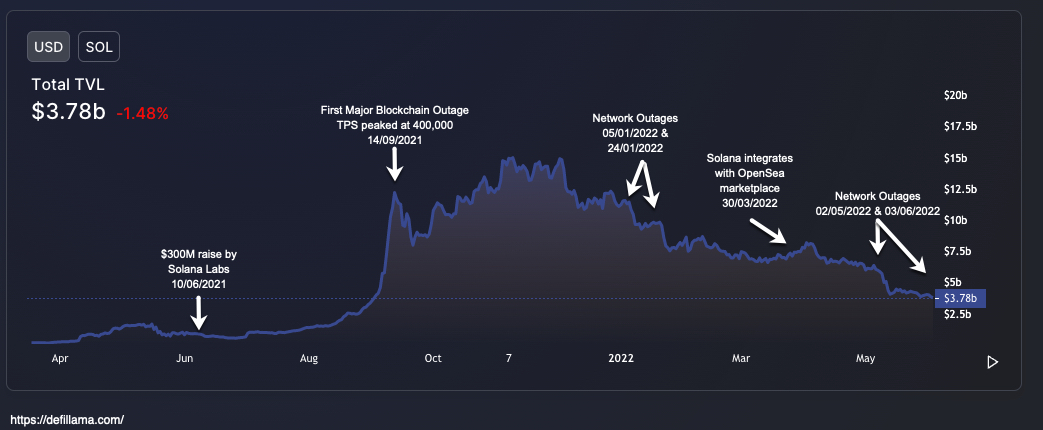

Total Value Locked in Solana

Solana is a high speed, low-cost layer one blockchain that supports smart contract interactions for decentralised applications and non-fungible tokens (NFTs). In regards to TVL size, Solana is currently ranked 5th – with a TVL of $3.8B and TVL dominance of 3.5%. Solanas’s low transaction costs and scalability solution make it an excellent alternative for those wanting to farm on a chain other than Ethereum. Solana’s top TVL project is Solend, a trusted money market used for lending and borrowing assets, contributing 13.65% of the TVL on Solana’s network. Serum (SRM) is Solanas’s largest DEX in terms of TVL with a value of $292.5M, only slightly ahead of Raydium (RAY) – TVL $285.4M.

Solana has success as low-cost and ultra-fast has led to network outages, with the first significant outage occurring for 24 hours in September 2021. The chart shows the adverse reaction of a sharp ~34% decline in TVL to the network being halted for one day. There have since been more outages, which have harmed the ecosystem’s TVL.

Key Statistics

- Accounts for 3.5% of TVL in DeFi.

- Solend is Solanas’s leading money market.

- Serum is leading DEX in Solana.

- Currently, $3.8B TVL in Solana, reaching an annual high of $11.6B at the start of January 2022.

Total Value Locked in Algorand

Algorand is currently one of the smaller up and coming ecosystems in the DeFi sector. It now has a total TVL of $126.9m, accounting for only 0.12% of TVL in DeFi. Algofi is the leading protocol in terms of TVL on Algorand, which is both the top money market and DEX on the network – current TVL is $82M. Alogrand’s scalability, high performance and security provide innovative DeFi developers with an excellent opportunity to build the future of DeFi protocols on their blockchain.

It is interesting to note that even where Algorand lacks in TVL size, it has made up for its consistent TVL growth. This could be attributed to the strategic Borderless Capital fund for Alogrand projects valued at $500M announced in December last year, highlighting the investment interest in projects launching on Algorand. This investment by Borderless Capital spans across Alogrand’s largest dApps such as Algofi, Tinyman, Folks Finance and Pact, which are the top 4 applications on Algorand with TVLs between $14M and $84M.

Key Statistics

- Accounts for 0.12% of TVL in DeFi.

- Currently, $126.9m TVL in Algorand, reaching an annual high of $185m at the start of May 2022.

- One of the only DeFi ecosystems that have enjoyed consistent TVL growth.

Analysing Ethereum and Competitors TVL

Below is a percentage comparison of Ethereum’s TVL with its competitors, some of which have been analysed above.

The Future of Defi for the Remainder of 2022

Although there have been recent drawdowns in the total value locked in DeFi, we still see new investors and development enter the space. DeFi is a highly regarded and essential financial service in the digital asset class. During the remainder of 2022, we expect new innovative DeFi projects to enter the space, whilst our favourite blue-chip assets mentioned throughout this article continue to build. TVL values in DeFi will most likely be unpredictable for the remainder of 2022. However, we at Apollo Capital are confident in the continual growth of developer activity in these various DeFi communities. DeFi has had two and a half years to mature into one of the essential verticals in the crypto industry completing. We look forward to investing, utilising and interacting with these protocols and chains moving into subsequent market cycles.